Збирач потоків

Mitsubishi Electric shipping samples of four new trench SiC MOSFET bare dies for power semiconductors

Phlux’s Noiseless InGaAs sensors attract interest for hunting and long-range shooting

Extend the LM358 op-amp family’s output voltage range

The LM358 family of dual op amps is among those hoary industry work-horse devices that are inexpensive and still have their uses. These parts’ outputs can approach (and for the inputs even include) their negative supply rail voltage. Unfortunately, this is not the case for the positive supply rail. However, cascading the op amp with a few simple, inexpensive components can surmount this limitation of the outputs.

Figure 1 This simple rail-to-rail gain stage, consisting of Q1, Q2, R1, Rf, Rg, Rcomp, and Ccomp, is driven by the output of the LM258A op-amp. Feedback network Rf1 and Rg1 help to ensure that the inverting input feedback voltage is within the op-amp’s common-mode input range and to set a stable loop gain characteristic.

Figure 1 This simple rail-to-rail gain stage, consisting of Q1, Q2, R1, Rf, Rg, Rcomp, and Ccomp, is driven by the output of the LM258A op-amp. Feedback network Rf1 and Rg1 help to ensure that the inverting input feedback voltage is within the op-amp’s common-mode input range and to set a stable loop gain characteristic.

I had some LM258As on hand, which I had bought instead of the LM358As because of the slightly better input offset voltage and bias current ratings, which also spanned a wider set of temperatures. Interestingly, the input common-mode range for the non-A version of the part is characterized over temperature as Vcc – 2V for Vcc between 5 and 30V. But the A version is characterized at 30-V only. Go figure! As you’ll see, the tests I ran encountered no difficulties.

The parts’ AC characteristics are spec’d identically, suggesting that the even cheaper LM358 should encounter no stability issues. With the components shown in Figure 1, the loop gain above 100 kHz is about that of the LM258A configured as a voltage follower. Below 10 kHz, there’s approximately an extra 8 dB of gain. The following (Figures 2 through Figure 7) are some screen shots of ‘scope traces for various tests of the circuit at 1 kHz. The scales for all traces are the same: 1 V and 200 µs per large divisions.

Figure 2 Here, rail-to-rail swings of the circuit’s output are apparent.

Figure 3 The circuit recovers from clipping gracefully.

Figure 4 With a 0.1 µF load, slewing problems arise.

Figure 5 A 470-ohm load in parallel with 0.1 µF is stable and doesn’t exhibit slewing problems.

Figure 6 But with 0.1 µF as the sole load, the circuit is not stable.

Figure 7 Swapping the 470-ohm Rcomp with 100-ohms restores stability with 0.1 µF as the sole load.

In conclusion, a pair of cheap transistors, an inexpensive cap, and a few non-precision resistors provide a cost-effective way to turn the LM358 family of op amps into one with rail-to-rail output capabilities.

Christopher Paul has worked in various engineering positions in the communications industry for over 40 years.

Related Content

- Simple PWM interface can program regulators for Vout < Vsense

- LM358 Datasheet and Pinout

- com: Experimenting with LM358 and OPA2182 ICs

- Tricky PWM Controller – An Analog Beauty!

- LED Lamp Dimmer Project Circuit

- Op amp one-shot produces supply-independent pulse timing

The post Extend the LM358 op-amp family’s output voltage range appeared first on EDN.

The AI design world in 2026: What you need to know

We live in an AI era, but behind the buzzword lies an intricate world of hardware and software building blocks. Like every other design, AI systems span multiple dimensions, ranging from processors and memory devices to interface design and EDA tools. So, EDN is publishing a special section that aims to untangle the AI labyrinth and thus provide engineers and engineering managers greater clarity from a design standpoint.

For instance, while AI is driving demand for advanced memory solutions, memory technology is taking a generational leap by resolving formidable engineering challenges. An article will examine the latest breakthroughs in memory technology and how they are shaping the rapidly evolving AI landscape. It will also provide a sneak peek at memory bottlenecks in generative AI, as well as thermal management and energy-efficiency constraints.

Figure 1 HBM offers higher bandwidth and better power efficiency in a similar DRAM footprint. Source: Rambus

Another article hits the “memory wall” currently haunting hyperscalers. What is it, and how can data center companies confront such memory bottlenecks? The article explains the role of high-bandwidth memory (HBM) in addressing this phenomenon and offers a peek into future memory needs.

Interconnect is another key building block in AI silicon. Here, automation is becoming a critical ingredient in generating and refining interconnect topologies to meet system-level performance goals. Then, there are physically aware algorithms that recognize layout constraints and minimize routing congestion. An article will show how the phenomena work while also showing how AI workloads have made existing chip interconnect design impractical.

Figure 2 The AI content in interconnect designs facilitates intelligent automation, which in turn, enables a new class of AI chips. Source: Arteris

No design story is complete without EDA tools, and AI systems are no exception. An EDA industry veteran writes a piece for this special section to show how AI workloads are forcing a paradigm shift in chip development. He zeroes in on the energy efficiency of AI chips and explains how next-generation design tools can help design chips that maximize performance for every watt consumed.

On the applications front, edge AI finally came of age in 2025 and is likely to make further inroads during 2026. A guide on edge AI for industrial applications encompasses the key stages of the design value chain. That includes data collection and preprocessing, hardware-accelerated processing, model training, and model compression. It also explains deployment frameworks and tools, as well as design testing and validation.

Figure 3 Edge AI addresses the high-performance and low-latency requirements of industrial applications by embedding intelligence into devices. Source: Infineon

There will be more. For instance, semiconductor fabs are incorporating AI content to modernize their fabrication processes. Take the case of GlobalFoundries joining hands with Siemens EDA for fab automation; GF is deploying advanced AI-enabled software, sensors, and real-time control systems for fab automation and predictive maintenance.

Finally, and more importantly, this special section will take a closer look at the state of training and inference technologies. Nvidia’s recent acquisition of Groq is a stark reminder of how quickly inference technology is evolving. While training hardware has captured much of the limelight in 2025, 2026 could be a year of inference.

Stay tuned for more!

Related Content

- The network-on-chip interconnect is the SoC

- An edge AI processor’s pivot to the open-source world

- Edge AI powers the next wave of industrial intelligence

- Four tie-ups uncover the emerging AI chip design models

- HBM memory chips: The unsung hero of the AI revolution

The post The AI design world in 2026: What you need to know appeared first on EDN.

Australia investing $1.2bn to create Critical Minerals Strategic Reserve

Cree LED launches fully assembled L2 PCBA solutions for indoor and outdoor lighting

Adoption of Electric Motorcycles: A Challenging Ride Ahead

India’s tryst with electric two-wheelers began as early as the 1990s, but meaningful momentum only arrived decades later. Early policy interventions—such as subsidies offered by the Ministry of New and Renewable Energy (MNRE) between 2010 and 2012—laid the groundwork. The launch of the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme further accelerated adoption, drawing both startups and legacy manufacturers into the electric mobility race.

Yet, despite this progress, one segment remains conspicuously underdeveloped: electric motorcycles. A joint NITI Aayog–TIFAC study published in June 2022 estimates that India’s two-wheeler manufacturing capacity could exceed 20 million units annually by 2030. However, electric motorcycles account for only a negligible fraction of this future potential.

Royal Enfield’s Electric Bet Rekindles DebateAs India’s foremost motorcycle manufacturer, Royal Enfield’s move into electric mobility represents more than product diversification—it marks a fundamental technological transition for a brand long associated with large-displacement engines, mechanical character, and long-distance touring capability. Entering the electric motorcycle space forces a redefinition of performance, shifting the emphasis from displacement and acoustics to torque delivery, thermal control, software, and system integration.

The company has signalled its electric intent through the Flying Flea platform, with two derivatives planned for launch after 2026. Beyond the product itself, the real story lies in the underlying technology stack Royal Enfield is building for the electric era.

According to Matt Cardenas, Head of EV Product Strategy at Royal Enfield, much of the vehicle’s technology has been developed in-house to optimise user experience. Over 200 engineers are engaged in powertrain development, with 42 patents already filed. The company has also partnered directly with NXP and Snapdragon to co-develop motorcycle-specific chips—an uncommon move in the two-wheeler industry.

For a company built on the appeal of powerful combustion motorcycles, Royal Enfield’s electric strategy suggests a broader reimagining of power itself. In the absence of exhaust notes and mechanical mass, performance is being reconstructed through torque curves, thermal discipline, and digital intelligence. How successfully this engineering-first approach translates into rider acceptance may ultimately determine whether electric motorcycles can move beyond the margins of India’s two-wheeler market.

Where Does India’s Electric Motorcycle Market Stand?In August 2025, NITI Aayog convened a high-level meeting with major two-wheeler OEMs—Hero MotoCorp, Bajaj Auto, TVS Motor, Ola Electric, Ather Energy, and Revolt Motors—to explore strategies for improving electric motorcycle adoption.

The current market structure highlights the challenge. Internal combustion engine (ICE) motorcycles still account for nearly two-thirds of India’s two-wheeler market. Electric scooters, by contrast, have achieved around 15% penetration within the EV segment and now represent almost one-third of all two-wheelers sold. Electric motorcycles, however, contribute just 0.1% of the total two-wheeler market, according to NITI Aayog.

It’s partly because motorcycle manufacturing is dominated by some heavy-loaded challenges, ranging from the weight of the battery to efficiency and experience.

The Weight of the Battery ProblemBattery weight remains one of the most fundamental constraints. Unlike four-wheelers, motorcycles are highly sensitive to mass distribution. For long-distance and off-road riding in particular, maintaining balance, agility, and stability becomes increasingly complex as battery size grows.

Engineers must carefully position the battery to preserve handling characteristics while reinforcing the frame without adding excessive weight. Ergonomics also demands rethinking, as the traditional engine layout is replaced by a bulkier energy storage system. Suspension and braking systems require complete recalibration to match the altered dynamics of an electric powertrain. In effect, designing an electric motorcycle is far more complex than simply swapping an engine for a motor.

Reflecting the same idea, Ather’s leadership has noted that practical and cost considerations currently favour electric scooters over bikes in India — an observation directly linked to the challenges electric motorcycles face in matching affordability and everyday utility.

Efficiency Gains That Don’t Fully TranslateOn paper, electric motors are vastly more efficient than ICEs, converting 80–90% of electrical energy into motion, compared to just 20–30% for combustion engines. Regenerative braking and fewer moving parts further enhance theoretical efficiency.

However, these advantages shrink when evaluated on a well-to-wheel basis. Petrol has a far higher energy density by weight than today’s lithium-ion batteries. A small fuel tank can deliver long range with minimal mass, while an equivalent amount of stored electrical energy adds substantial weight. For long-distance riding at sustained speeds, the heavier battery pack can negate much of the motor’s inherent efficiency advantage, resulting in shorter real-world range than ICE motorcycles.

Transmission, Maintenance, and the Rider’s BondElectric scooters have benefited from simple, gearless drivetrains that translate easily into electric architectures. Motorcycles, especially those with gears, face greater design and manufacturing complexity. This also affects maintenance and repair—areas of particular importance to India’s motorcycle culture, where self-repair and aftermarket modifications are deeply ingrained. Limited service familiarity and proprietary components can dampen enthusiasm among seasoned riders.

The Sound of SilenceFor many long-distance and enthusiast riders, motorcycles are as much about emotion as engineering. The sound, vibration, and mechanical feedback of a combustion engine form a core part of the riding experience. Electric motorcycles, with their near-silent operation, can feel less visceral—even if they deliver superior acceleration.

That said, this argument is not universal. Electric bikes offer tangible benefits: drastically reduced noise pollution, smoother power delivery, and instant torque that can feel both controlled and exhilarating. For a new generation of riders, these attributes may redefine what performance and pleasure mean on two wheels.

A Weak Global Reference EcosystemGlobally, electric motorcycles lack the ecosystem support that helped electric scooters scale. The NITI Aayog study notes the absence of learning spillovers from international markets. While India benefited from mature Chinese supply chains and proven designs in e-scooters, no comparable global blueprint exists for electric motorcycles. As a result, manufacturers must build R&D capabilities largely from scratch.

Only a handful of players—Revolt Motors, Ultraviolette Automotive, Oben Electric, and Matter Motors—are currently active in India’s electric motorcycle space. This contrasts sharply with the success of Ola Electric and Ather Energy in the scooter segment. Internationally, the picture has also dimmed, highlighted by the bankruptcy of Italian high-performance EV motorcycle maker Energica in October 2024. While brands like Kawasaki and Zero remain prominent globally, volumes remain limited.

Also, executives from Bajaj Auto’s electric two-wheeler business have acknowledged that the industry initially struggled with supply chain readiness and cost structures, and that building a sustainable EV business requires a measured approach rather than aggressive cash burn — indirectly underscoring how complexity and cost are barriers for electrifying performance-oriented two-wheelers.

The Road AheadFor now, innovation appears to be the only force capable of sustaining momentum in electric motorcycles. Breakthroughs in battery chemistry, thermal management, lightweight materials, and modular platforms will be critical. Until governments worldwide offer stronger policy support—through targeted subsidies, charging infrastructure, and R&D incentives—electric motorcycles are likely to remain a passion project rather than a mass-market reality.

The ride ahead, much like the machines themselves, will demand balance, patience, and relentless engineering ingenuity.

The post Adoption of Electric Motorcycles: A Challenging Ride Ahead appeared first on ELE Times.

Edge AI Chipsets: How On-Device Intelligence Is Reshaping Embedded System Design

The cloud-first model for embedded systems is becoming a legacy architecture. We’re moving away from simply piping data to remote servers and instead shifting the entire decision engine onto the bare metal. Driven by specialised Edge AI silicon-like NPUs and accelerated RISC-V cores, this evolution allows us to bake autonomous logic directly into sensors and controllers. In a production environment, on-device AI is a functional requirement, not a luxury. As NVIDIA CEO Jensen Huang noted in his 2025 GTC keynote, “The next wave is already happening… Robotics, which has been enabled by physical AI-AI that understands the physical world, is the new era,” marking a definitive shift toward intelligence that lives where the action occurs.

Here is why Several factors make on-device AI critical today:

- Solving Latency: In robotics or power-grid monitoring, a cloud round-trip is a system failure. You need deterministic, sub-millisecond responses that only local inference provides.

- Cutting the Bandwidth Tax: Constant streaming drains batteries and budgets. Local processing means we only transmit the “meaning,” not the raw noise, making massive IoT fleets cost-effective.

- Hardened Privacy: For medical or industrial IP, data in transit is a liability. Keeping telemetry on the silicon is the most effective way to ensure confidentiality. Cristiano Amon, CEO of Qualcomm, reinforces this, stating: “When you do the processing on the device, it’s immediate. You don’t have to wait. It’s private. It’s your data. It’s your personal graph that stays with you.

- True Autonomy: Your hardware shouldn’t brick when the Wi-Fi drops. Edge AI ensures the machine stays smart in remote or “noisy” environments.

These factors collectively make Edge AI an essential enabler of modern embedded intelligence.

Architectural Distinctions of Edge AI Chipsets

Edge AI chipsets differ from conventional microcontrollers (MCUs) and CPUs in architectural intent and operational efficiency. Core characteristics include:

- AI Accelerators (NPUs/VPUs): Dedicated engines built for neural-network inference (convolutions, matrix multiplications) that significantly exceed CPUs in speed and power efficiency.

- Heterogeneous SoC Architectures: A combination of CPU (control tasks), NPU (AI inference), and sometimes GPU (parallel processing), ensures optimised resource allocation across workloads.

- Model Optimisation: Deep learning models can be deployed on devices with limited resources without experiencing significant accuracy loss thanks to techniques like quantisation, pruning, and compression.

- Power & Thermal Management: Edge AI can function within stringent power and temperature constraints thanks to dynamic voltage and frequency scaling, low-power modes, and thermal improvements.

- Security & Reliability Features: Protection of sensitive operations-particularly in industrial deployments and critical infrastructure achieved through measures such as memory isolation, secure boot processes, and hardware-level tamper-resistant design.

By combining these features, edge-AI chipsets make intelligent behaviour feasible on devices previously incapable of complex decision-making.

Transforming Embedded System Design

The introduction of Edge AI fundamentally alters embedded system design:

- From Reactive to Cognitive Systems: Traditional embedded devices follow deterministic logic to detect defects, predict equipment failures and monitor the electronic equipment. Edge AI enables them to perceive, classify, and act autonomously.

- Real-Time Autonomy: With local inference, devices operate independently of cloud connectivity, critical for industrial, safety-critical, or remote applications.

- Distributed Intelligence & Scalability: Large IoT deployments can now distribute AI across nodes, reducing network load and ensuring real-time responsiveness.

- Energy and Bandwidth Efficiency: Local processing cuts down on data transmission, which saves energy and money and makes the system less reliant on centralized infrastructure.

- Cross-Layer Co-Design: Hardware-software co-design is now essential. Teams must optimise model architecture, memory allocation, runtime scheduling, and power management from the outset.

Edge AI thus transforms embedded systems from simple controllers into autonomous, intelligent agents capable of learning and decision-making.

Real-World Applications

Edge AI chipsets are already revolutionising multiple sectors:

- Industrial Automation & Smart Manufacturing: Vision-based defect detection, predictive maintenance, anomaly detection, and real-time monitoring of inverters, EV chargers, and SMPS.

- Embedded Vision & IoT: Smart cameras, object detection, robotics, drones, and smart sensors with on-device analytics.

- Consumer Electronics & Wearables: Offline voice recognition, gesture detection, and biometric authentication while preserving privacy.

- Energy & Power Electronics: Autonomous monitoring of power converters, predictive fault detection, and safety-critical decisions in EV and renewable energy systems.

- Agriculture & Remote Infrastructure: Edge AI sensors classify crop health, monitor environmental conditions, and operate autonomously in rural or low-connectivity areas.

These applications illustrate that Edge AI is no longer experimental – it’s a practical enabler for real-world intelligence in embedded systems.

Challenges and Considerations

While Edge AI presents opportunities, several challenges require careful engineering:

- Resource Constraints: Limited compute, memory, and power require model optimisation, which may impact accuracy or capability.

- Hardware Heterogeneity: Diverse SoCs and NPUs make deployment across platforms complex.

- Thermal and Power Management: Continuous inference can generate heat and consume power, impacting device lifespan.

- Security & Trust: Edge devices handling sensitive data must ensure secure boot, encryption, and tamper resistance.

- Model Lifecycle Management: Updating and maintaining models across fleets of devices, especially in remote locations, is a significant operational challenge.

- Design Complexity: Effective deployment demands collaboration between ML engineers, hardware designers, and embedded software developers.

Addressing these challenges is essential for scalable, robust, and efficient Edge AI implementations.

Emerging Trends & the Road Ahead

Edge AI chipsets are evolving rapidly:

- TinyML and Micro-Edge Devices: Ultra-low-power NPUs enable AI on minimal sensors and microcontrollers.

- Chiplet-Based Modular SoCs: Modular architectures combining CPUs, AI accelerators, and memory provide scalable, upgradeable solutions.

- Cross-Layer Automation: Improved toolchains for quantisation, pruning, scheduling, and deployment reduce manual tuning and accelerate development.

- Hybrid Edge-Cloud Models: On-device inference combined with federated learning or cloud aggregation balances autonomy with long-term model improvement.

- Enhanced Security: Trusted execution environments and secure hardware primitives protect distributed edge deployments.

These trends point toward embedded systems that are intelligent, autonomous, energy-efficient, and scalable across industries.

India’s Emerging Edge AI Ecosystem

India is rapidly contributing to the global Edge AI landscape. Startups and MNCs like Netrasemi, Mindgrove Technologies, InCore Semiconductors, and MosChip Technologies are developing edge-AI SoCs, NPUs, and embedded solutions tailored for industrial, automotive, and IoT applications. With government initiatives like Digital India and Make in India, combined with academic research, the country is fostering innovation in Edge AI for both domestic and global markets.

Conclusion

Edge AI chipsets are changing what we expect from embedded devices. Work that once had to be pushed to a central system can now be handled directly where the data is produced. This allows equipment to react immediately, even in environments where connectivity is unreliable or power is limited. Designing such systems is no longer just a matter of selecting a processor and writing code; it involves careful trade-offs between performance, power use, reliability, and long-term maintenance, with security built in from the start. As AI visionary Andrew Ng recently summarised, “The future AI wealth doesn’t belong to those who own the largest GPU clusters but to those who know how to use the smallest models to solve the most specific problems… Edge computing and small models are the wealth keys.

For engineers in the embedded domain, this is a practical turning point rather than a theoretical one. Devices are moving beyond fixed, single-purpose roles and taking on more responsibility within distributed setups. Edge AI enables the development of autonomous and efficient systems. These solutions deliver the consistent reliability required by various industries.

The post Edge AI Chipsets: How On-Device Intelligence Is Reshaping Embedded System Design appeared first on ELE Times.

Quantum-Safe Hardware: Why the Cybersecurity Deadline Is Closer Than the Quantum Breakthrough

The world’s digital infrastructure is quietly approaching a cryptographic inflexion point. For decades, global cybersecurity has relied on a small set of mathematical assumptions, most notably RSA and elliptic-curve cryptography. These assumptions underpin everything from cloud authentication and mobile networks to payment systems, defence communications, and digital identity. Quantum computing threatens not to weaken these foundations, but to invalidate them entirely.

What makes this transition uniquely dangerous is not the arrival of quantum computers themselves, but the mismatch between how fast cryptography can be broken and how slowly hardware trust systems can be replaced. This is not a software problem that can be patched overnight. It is a hardware lifecycle problem measured in decades. As quantum research accelerates and post-quantum cryptography standards solidify, a hard truth is emerging across the industry: quantum-safe hardware must be deployed well before quantum computers can break encryption. Waiting for certainty is, paradoxically, the fastest path to systemic insecurity.

From Mathematical Risk to Engineering Reality

Quantum computing represents a rare technological disruption where the threat is mathematically inevitable, not probabilistic. Shor’s algorithm does not weaken RSA or elliptic-curve cryptography; it nullifies them. Once fault-tolerant quantum computers emerge, today’s cryptographic foundations collapse outright. More critically, attacks need not be real-time: encrypted data captured today can be decrypted years later under the “harvest now, decrypt later” model.

As Ali El Kaafarani, CEO of PQShield, has consistently argued, the industry’s mistake is treating post-quantum cryptography as a future software upgrade rather than a present hardware engineering challenge. Once quantum decryption is possible, compromise is retroactive; you don’t lose today’s secrets, you lose yesterdays. This reality has shifted focus from cryptographic theory to what can be implemented in silicon. While many PQC schemes exist on paper, only a narrow set survives real-world constraints of memory, power, latency, and side-channel resistance. Lattice-based algorithms such as NIST-standardised Kyber and Dilithium are currently the most hardware-viable, though they still impose significant demands. Other approaches, like code-based cryptography, struggle with impractically large key sizes that overwhelm secure hardware resources.

Why Hardware, Not Software, Is the Real Battleground

Cryptography is enforced by hardware roots of trust, HSMs, secure elements, TPMs, SIMs, and embedded controllers that underpin secure boot, identity, and key protection. Post-quantum cryptography breaks the assumptions these systems were built on: larger keys and heavier computation quickly expose the limits of hardware optimised for RSA and ECC. While software can absorb this overhead, hardware-bound systems cannot.

This is where “crypto-agility” fractures. Many platforms claim algorithm agility, but in practice, it exists only at the firmware or API layer, not in silicon. As Todd Moore, Vice President of Data Security Products at Thales, has noted, true crypto-agility is about whether hardware can evolve without becoming a performance bottleneck. In high-throughput environments, first-generation “PQC-ready” hardware often works functionally but not economically, forcing a choice between degraded performance and early replacement. Crypto-agility is no longer a software feature; it is a physical property of hardware architecture.

The Myth of Universal Crypto-Agility

In response to quantum risk, many vendors describe their products as “crypto agile.” In practice, crypto-agility has often meant that software can be updated, while the underlying hardware remains fixed. That model is breaking down. True crypto-agility in the post-quantum era requires hardware that was designed with uncertainty in mind: spare compute capacity, flexible accelerators, sufficient secure memory, and firmware update paths that are themselves resistant to quantum attacks. Much of the hardware deployed today, particularly older HSMs and embedded roots of trust, does not meet this bar.

Newer platforms from vendors such as Thales and Entrust are moving toward genuinely post-quantum-ready architectures, but even here, the industry is candid that early PQC support is only a first step. In many environments, especially high-throughput systems like certificate authorities and telecom authentication servers, performance collapses when PQC is layered onto hardware never designed for it. The uncomfortable implication is that a significant portion of deployed cryptographic hardware will ultimately need physical replacement, not because it is insecure today, but because it cannot scale securely tomorrow.

The Long-Life Device Problem: Secure Boot and Identity

Quantum risk becomes existential when hardware is expected to remain trusted for 15–20 years. Industrial equipment, telecom infrastructure, vehicles, medical devices, and defence systems often outlive multiple cryptographic generations. If the firmware-signing keys protecting these systems become quantum-breakable mid-lifecycle, attackers gain the ability to install malicious updates that appear fully legitimate.

To address this, hardware designers are rethinking trust from the ground up. Secure boot chains are increasingly being designed around hybrid verification models, where classical and post-quantum signatures coexist during a long transition period. Device identity is shifting toward roots of trust that can support PQC natively, rather than bolting it on later.

Equally important is the ability to migrate trust anchors in the field. Hardware that cannot rotate its cryptographic identity without physical access becomes a liability the moment quantum attacks become practical. In this sense, quantum-safe hardware is no longer just a security feature; it is a prerequisite for product longevity.

Scale Changes Everything

Post-quantum cryptography is feasible at a small scale. The real challenge emerges at volume. Larger keys and signatures mean more data moving through networks, more bytes stored in certificates, and more cycles spent on verification. In isolation, these costs are manageable. At the scale of global telecom networks, payment systems, and cloud platforms, they become systemic.

Cloud providers have already found that naïve PQC deployment can inflate handshake sizes enough to affect latency and throughput. Telecom operators face similar issues in authentication signalling, where milliseconds matter. This is why hybrid cryptography combining classical and post-quantum algorithms has become the dominant near-term strategy. Hardware acceleration is the critical enabler here. When PQC is supported at the silicon level, much of the overhead becomes manageable. When it is not, performance penalties cascade across the system.

The Real Deadline No One Wants to Announce

Public timelines often place cryptographically relevant quantum computers in the early to mid-2030s. Internally, many security leaders plan as if the deadline is earlier. The reason is simple: hardware migration takes time. From design and validation to certification and deployment, replacing cryptographic hardware across critical infrastructure can take a decade. Waiting for definitive proof that quantum computers can break RSA guarantees that the response will come too late. A pragmatic consensus is forming across the industry. By the second half of this decade, all new cryptographic hardware procurement must be quantum-safe by design. By the end of the decade, high-value infrastructure must complete the transition. Anything beyond those risks turning today’s encrypted data into tomorrow’s breach archive.

As Marco Pereira, Global Head of Cybersecurity at Capgemini, has emphasised about quantum risk “Quantum readiness isn’t about predicting a date, it’s about managing irreversible risk. Every encrypted asset today could become tomorrow’s breach if organisations delay adopting post-quantum protections.

Quantum-safe hardware is not driven by fear of the unknown. It is driven by certainty that cryptography is bounded by physics, certainty that hardware lifecycles are slow, and certainty that data longevity outlasts algorithm lifetimes. The organisations that navigate this transition successfully will not be those that deploy post-quantum cryptography fastest in software, but those that redesign their hardware roots of trust early, with crypto-agility, scale, and long-term integrity at the core. In the quantum era, cybersecurity failures will not arrive with alarms or outages. It will arrive quietly, years after the data was first captured. The only winning strategy is to make that data permanently useless before the quantum key ever turns.

The post Quantum-Safe Hardware: Why the Cybersecurity Deadline Is Closer Than the Quantum Breakthrough appeared first on ELE Times.

SQL Server IoT 2025: Why It Matters for Embedded and OEM Systems

Courtesy: Arrow Electronics

The new SQL Server IoT 2025 is now available! If you build devices, appliances, or embedded systems that ship with a database inside, SQL Server IoT 2025 is worth a serious look. It brings the SQL Server 2025 engine into long-life, fixed-function products. You get the full engine, the same AI features, the same JSON and vector capabilities, and the same security improvements. The only difference is that it is packaged and licensed for OEM and embedded scenarios.

In my experience supporting embedded customers, the pattern is consistent. More data at the edge, tight security requirements, long product lifecycles, and pressure to support AI without adding cloud dependencies. SQL Server IoT 2025 helps you handle those problems without changing how you design your systems. You can use the same T-SQL, drivers, tools, containers, and development workflow.

AI where your device runs

The biggest change in SQL Server IoT 2025 is the built-in AI stack. The database now supports a native vector type, semantic search, hybrid search, and local or remote model execution. You can generate embeddings inside the engine, and you can run AI agents through a secure REST endpoint that SQL Server manages.

Nothing in this requires a cloud connection unless you choose to use one. You can keep models local by using Ollama or ONNX Runtime. You can also call cloud models through Azure OpenAI or OpenAI.

For embedded systems, this means you can build features that previously required a cloud round-trip. Examples include local anomaly detection, troubleshooting assistance, natural language search of manuals or logs, and smarter automation. If you already store your device data in SQL Server, the new vector features let you use that data immediately.

Security that matches modern requirements

The platform is secure out of the box. SQL Server IoT 2025 carries forward the security updates from SQL Server 2025. That includes TLS 1.3, TDS 8.0, PBKDF hashing, managed identities, and stricter defaults. This helps you ship hardware that is ready for audit and compliance checks. For teams in healthcare, manufacturing, or other controlled industries, this reduces significant design risk.

Performance improvements that help small systems

Most devices in the field run on constrained compute, so predictable behaviour underload becomes more important than raw horsepower. SQL Server IoT 2025 benefits from improvements like optimised locking, Lock After Qualification, tempdb governance, faster failover, and reduced contention during heavy workloads.

Your device can run more predictable workloads with fewer stalls. It starts faster, handles concurrency better, and gives you cleaner behaviour when something in the system misbehaves.

Better ways to move data out of the device

You also get Change Event Streaming, which pushes changes directly to Azure Event Hubs. The engine streams committed transactions without extra system tables. This helps when your design needs low-latency reporting or coordination with services outside the device.

If you use Microsoft Fabric, SQL Server IoT 2025 supports database mirroring directly into OneLake. That gives you a simple path to analytics or long-term storage without writing ETL code.

Developer workflow stays simple

Stability in the toolchain is just as important as stability in the engine. SQL Server IoT 2025 uses the same drivers, SSMS, VS Code extension, containers, and deployment workflow. You also get the new JSON type, JSON indexing, RegEx functions, Base64 utilities, and improved T-SQL functions that SQL Server 2025 introduces.

When an upgrade is worth it

If you are trying to decide whether this upgrade is worth it, these are the points that usually guide the decision:

- If your device is running SQL Server 2014 or 2016, you are past or near the end of mainstream support, and the extended support runway is shrinking fast. SQL Server IoT 2025 offers a long-life option with a modern engine, stronger security, and a cleaner feature set for long-term maintenance. You also get improvements like accelerated recovery, better indexing behaviour, and up-to-date drivers.

- If your product roadmap includes AI features or if customers are asking for analytics without sending data off the device, SQL Server IoT 2025 gives you a built-in way to handle that.

- If your company is standardising on Fabric or Azure Arc, IoT 2025 fits neatly into that architecture.

If your design team is trying to reduce custom code around queues, logs, or sync processes, IoT 2025 reduces that work.

The post SQL Server IoT 2025: Why It Matters for Embedded and OEM Systems appeared first on ELE Times.

Microchip Releases Plastic Transient Voltage Suppressors for A&D Applications

Microchip Technology announced the release of its JANPTX family of non-hermetic plastic Transient Voltage Suppressor (TVS) devices that meet the MIL-PRF-19500 qualification, offering high-reliability protection for aerospace and defence applications. These TVS devices are the first in the industry to achieve MIL-PRF-19500 qualification in a plastic package, offering engineers a lightweight, cost-effective solution without sacrificing stringent military performance requirements. The JANPTX product line is available in voltage ranges from 5V to 175V and includes five variants: JANPTX1N5555UJ, JANPTX1N5558UG, JANPTX1N5629AUJ, JANPTX1N5665AUG, JANPTX1N5907UG and JANPTX1N5907UJ.

With a high peak pulse power rating of 1.5 kW and clamping response times measured at less than 100 picoseconds in internal tests, the JANPTX family is designed to help ensure the safety and reliability of sensitive electronic components in demanding environments. Designed for surface mounting, these unidirectional TVS devices deliver protection against voltage transients such as lightning strikes, electrostatic discharge (ESD), and electrical surges.

Key Features of the TVS Devices

- Surface-mount unidirectional TVS design

- Can suppress transients up to 1,500W at 10/1000 µs

- Capable of clamping transients in less than 100 ps

- Working voltage range: 5V to 175V

- Military qualification: MIL-PRF-19500/716

- Equivalent hermetic packages available for surface mount and thru-hole

- Weight: ~0.25 grams

Development Tools

The JANPTX devices are supported by various SPICE models, which enable the virtual prediction and simulation of a circuit’s behaviour, eliminating the need for time-consuming physical prototyping and redesigns.

The post Microchip Releases Plastic Transient Voltage Suppressors for A&D Applications appeared first on ELE Times.

Týr-the-Pruner: Search-based Global Structural Pruning for LLMs

Courtesy: AMD

Key Takeaways:

- End-to-end global structural pruning: Týr-the-Pruner jointly optimises pruning and layer-wise sparsity allocation, avoiding two-stage global ranking pipelines.

- Multi-sparsity supernet with expectation-aware error modelling: Layers are pruned at multiple sparsity levels and evaluated collectively to capture cross-layer dependencies.

- Coarse-to-fine evolutionary search under a fixed sparsity budget: Sparsity-shift mutations preserve global constraints while progressively refining resolution (12.5% → 1.56%).

- Taylor-informed, backprop-free local pruning: First- and second-order saliency guides structured pruning with minimal functional drift.

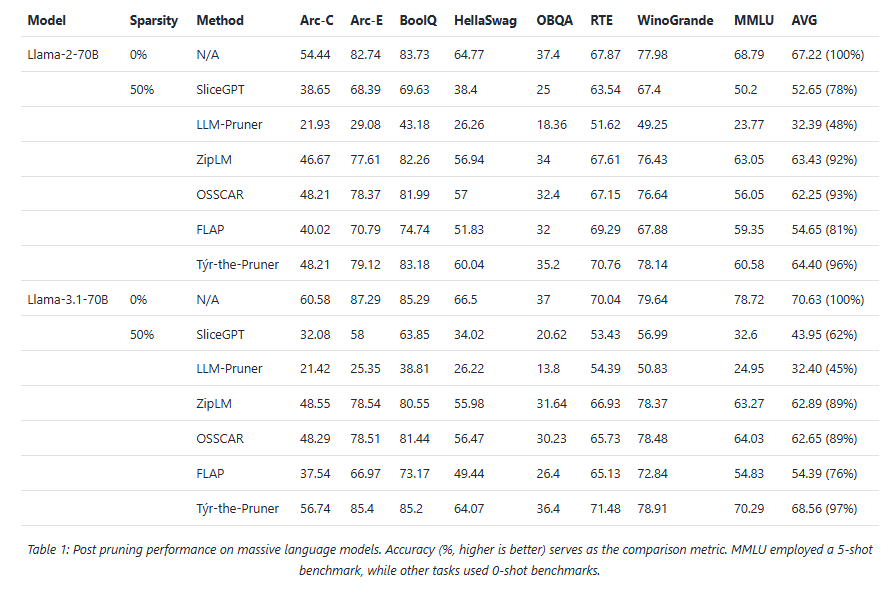

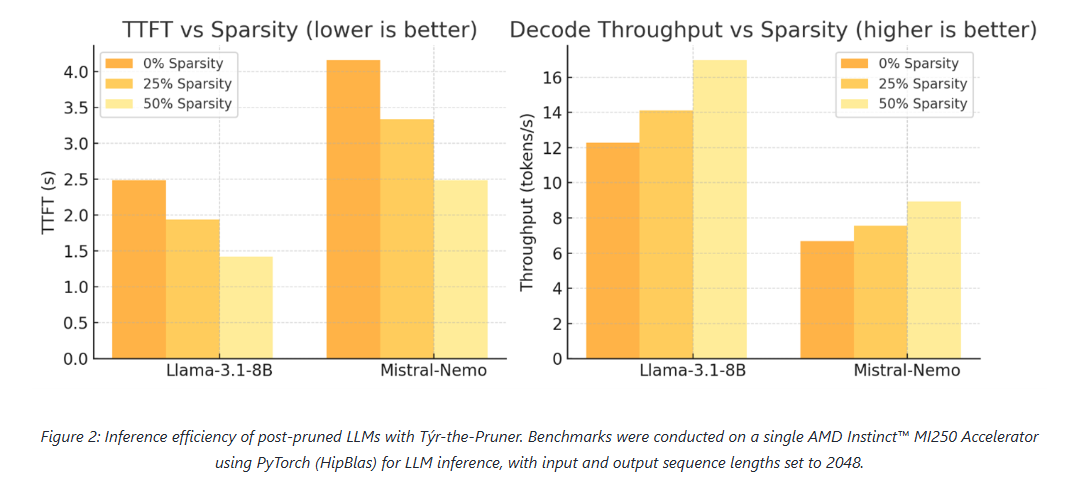

- Near-dense accuracy with real hardware gains: Up to 50% parameter reduction retains ~97% accuracy on Llama-3.1-70B, accelerating inference on AMD Instinct GPUs.

As large language models (LLMs) scale into the tens and hundreds of billions of parameters, pruning has re-emerged as a critical lever for improving inference efficiency without sacrificing accuracy. AMD’s Týr-the-Pruner advances this frontier with a search-based, end-to-end framework for global structural pruning, delivering up to 50% parameter reduction while retaining ~97% of dense accuracy on Llama-3.1-70B—a new state of the art among structured pruning methods.

Accepted to NeurIPS 2025, the work also demonstrates tangible inference speedups on AMD Instinct GPUs, reinforcing pruning’s relevance not just as a compression technique, but as a practical path to deployment-scale efficiency.

Why global sparsity matters

Local structural pruning is appealing for its simplicity and efficiency: layers are pruned independently, often allowing even hundred-billion-parameter models to fit on a single device. However, this approach enforces uniform per-layer sparsity, overlooking how errors and redundancies propagate across layers.

Existing “global” pruning methods attempt to address this by first ranking substructures across layers and then pruning accordingly. While intuitive, this two-stage pipeline breaks end-to-end optimisation and struggles to capture inter-layer interactions.

Týr-the-Pruner flips the paradigm. Instead of ranking structures before pruning, it first constructs a multi-sparsity supernet and then searches directly for the optimal layer-wise sparsity distribution under a fixed global budget—yielding a truly end-to-end global pruning strategy.

Inside Týr-the-Pruner: How It Works

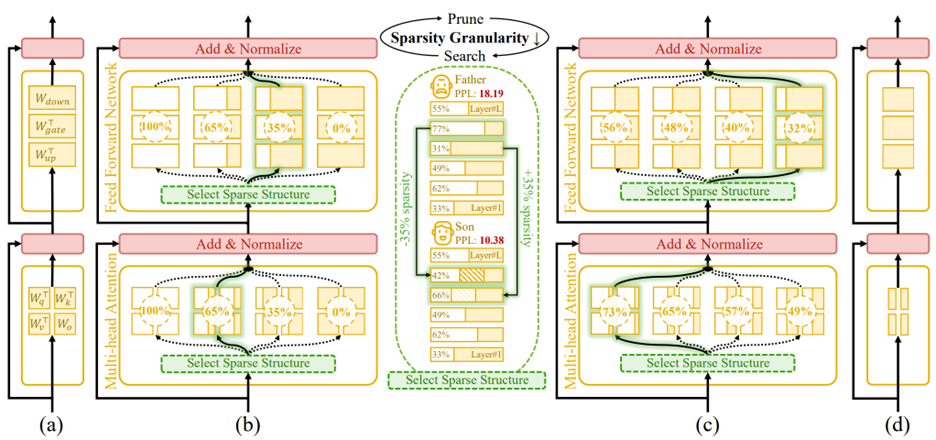

Figure 1. An overview of Týr-the-Pruner. Large language models (a) will be effectively locally pruned across multiple sparsity ratios and constructed into a supernet (b). An iterative prune-and-search strategy will be used to select the optimal sparse structure for each layer while maintaining a target overall sparsity ratio: pruning and sparsity-shift-driven evolutionary search are implemented iteratively with a coarse-to-fine sparsity interval granularity (c). Ultimately, the post-pruned LLM with the optimal sparsity distribution (d) is obtained.

Building a Reliable Supernet

The process begins by locally pruning every layer across multiple sparsity levels. Týr employs Taylor-informed saliency (first- and second-order) alongside backprop-free weight adjustment, applied progressively to minimise performance perturbations.

To ensure that different pruned variants remain mutually consistent, the framework introduces expectation-aware error accumulation, addressing the otherwise ambiguous error propagation that arises when multiple pruned copies coexist within a supernet.

Coarse-to-Fine Global Search

Once the supernet is established, Týr performs an evolutionary sparsity-shift search. Each mutation preserves the global sparsity budget—for example, making one layer slightly denser while another becomes equivalently sparser. Candidate models are evaluated using distillation-based similarity metrics over hidden activations and logits.

A naïve fine-grained search would be intractable: for an 80-sublayer model, even modest sparsity resolution would imply an astronomically large configuration space. Týr sidesteps this with an iterative coarse-to-fine strategy:

- The search begins with a coarse sparsity interval (12.5%) and just nine candidates per layer.

- After identifying a strong sparsity pattern, the search recentres and halves the interval (12.5% → 6.25% → 3.13% → 1.56%).

- After four iterations, Týr reaches fine-grained sparsity resolution while keeping each iteration’s effective search space manageable.

This design steadily narrows the search, accelerates convergence, and efficiently uncovers the optimal global sparsity distribution.

Results: Accuracy and efficiency on AMD hardware

Across models and benchmarks, Týr-the-Pruner consistently preserves near-dense accuracy while delivering meaningful efficiency gains on AMD Instinct MI250 accelerators.

At 50% sparsity, the method retains 96–97% average accuracy on 70B-scale models—outperforming structured pruning approaches such as SliceGPT, LLM-Pruner, and FLAP. On smaller models, the runtime benefits are equally compelling: for Llama-3.1-8B and Mistral-Nemo, pruning cuts time-to-first-token by up to 1.75× and boosts decode throughput by up to 1.38×.

These results position pruning as a first-class optimisation technique for large-scale LLM inference, particularly on modern accelerator architectures.

Practical Considerations: Memory and Search Efficiency

While supernets can be large, Týr keeps memory usage close to that of a single dense model by storing pruned substructures on disk and loading only the active subnet into high-bandwidth memory. Disk footprints remain manageable—around 40 GB for 7–8B models and ~415 GB for 70B models—with older artefacts cleaned up between iterations.

The evolutionary search itself is computationally efficient. Evaluations proceed under progressively increasing token budgets (2K → 16K → 128K), converging rapidly thanks to the coarse-to-fine schedule. For 8B-scale models, a single search iteration completes in a few hours, keeping overall runtime well within practical limits.

Summary

Týr-the-Pruner represents a shift in how global structural pruning is approached. By unifying pruning and sparsity allocation into a single, end-to-end search process—and combining it with expectation-aware error modelling and coarse-to-fine optimisation—the framework achieves both high accuracy retention and real-world inference acceleration.

With up to 50% parameter reduction and ~97% accuracy preserved on Llama-3.1-70B, Týr-the-Pruner demonstrates that global pruning can be both principled and practical—setting a new benchmark for structured pruning in the era of large-scale LLM deployment.

The post Týr-the-Pruner: Search-based Global Structural Pruning for LLMs appeared first on ELE Times.

LEDS Manufactured Backwards

| My college Electronics class final was to simply solder on parts of a pre-made circuit, and in my case it was an LED Christmas Tree. After soldering 36 TINY AS HELL LEDS, I tested it and there was no lights turning on…. Decided to test an extra LED and turns out the legs were manufactured with the long leg as the negative side and the short leg as the positive side. I’m so cooked [link] [comments] |

Wolfspeed produces single-crystal 300mm silicon carbide wafer

Altum RF renews ISO 9001:2015 certification

📱Конференція трудового колективу КПІ ім. Ігоря Сікорського

26 січня 2026 року відбудеться конференція трудового колективу КПІ ім. Ігоря Сікорського у залі засідань Вченої ради.

5 octave linear(ish)-in-pitch power VCO

A few months back, frequent DI contributor Nick Cornford showed us some clever circuits using the TDA7052A audio amplifier as a power oscillator. His designs also demonstrate the utility of the 7052’s nifty DC antilog gain control input:

- Power amplifiers that oscillate—deliberately. Part 1: A simple start.

- Power amplifiers that oscillate—deliberately. Part 2: A crafty conclusion.

Eventually, the temptation to have a go at using this tricky chip in a (sort of) similar venue became irresistible. So here it is. See Figure 1.

Figure 1 A2 feedback and TDA7052A’s antilog Vc gain control create a ~300-mW, 5-octave linear-in-pitch VCO. More or less…

Figure 1 A2 feedback and TDA7052A’s antilog Vc gain control create a ~300-mW, 5-octave linear-in-pitch VCO. More or less…

The 5-V square wave from comparator A2 is AC-coupled by C1 and integrated by R1C2 to produce an (approximate) triangular waveshape on U1 pin 2. This is boosted by A1 by a gain factor of 0dB to 30dB (1 to 32) according to the Vcon gain control input to become complementary speaker drive signals on pins 5 and 8.

A2 compares the speaker signals to its own 5-V square wave to complete the oscillation-driven feedback loop thusly. Its 5-V square wave is summed with the inverted -1.7-Vpp U1 pin 8 signal, divided by 2 by the R2R3 divider, then compared to the noninverted +1.7-Vpp U1 pin 5 signal. The result is to force A2 to toggle at the peaks of the tri-wave when the tri-wave’s amplitude just touches 1.7 Vpp. This causes the triangle to promptly reverse direction. The action is sketched in Figure 2.

Figure 2 The signal at the A2+ (red) and A2- (green) inputs.

This results in (fairly) accurate regulation of the tri-wave’s amplitude at a constant 1.7 Vpp. But how does that allow Vcon to control oscillation frequency?

Here’s how.

The slope of the tri-wave on A1’s input pin 2 is fixed at 2.5v/(R1C2), or 340 v/s. Therefore, the slopes of the tri-waves on A1 output pins 5 and 8 equal ±U1gain*340 v/s. This means the time required for those tri-waves to ramp through each 1.7-V half-cycle = 1.7/(U1gain*340v/s) = 5ms/U1gain.

Thus, the full cycle time = 2*(5ms/U1gain) = 10ms/U1gain, making Fosc = 100Hz*A1gain.

A1 gain is controlled by the 0- to 2-V Vc input. The Vc input is internally biased to 1 V with a 14-kΩ equivalent impedance as illustrated in Figure 3.

Figure 3 R4 works with the 14 kΩ internal Vc bias to make a 5:1 voltage divider, converting 0 to 2 V into 1±0.2 V.

R4 works into this, making a 5:1 voltage division that converts the 0 to 2 V suggested Vc excursion to the 0.8 to 1.2 V range at pin 4. Figure 4 shows the 0dB to 30dB gain range this translates into.

Figure 4 Vc’s 0 to 2 V antilog gain control span programs A1 pin 4 from 0.8 V to 1.2 V for 1x to 32x gain and Fosc = 100HzA1gain = 100Hz(5.66Vc) = 100 to 3200Hz

The resulting balanced tri-wave output can make a satisfyingly loud ~300 mW warble into 8 Ω without sounding too obnoxiously raucous. A basic ~50-Ω rheostat in series with a speaker lead can, of course, make it more compatible with noise-sensitive environments. If you use this dodge, be sure to place the rheostat on the speaker side of the connections to A2.

Meanwhile, note (no pun) that the 7052 data sheet makes no promises about tempco compensation nor any other provision for precision gain programming. So neither do I. Figure 1’s utility in precision applications (e.g., music synthesis) is therefore definitely dubious.

Just in case anyone’s wondering, R5 was an afterthought intended to establish an inverting DC feedback loop from output to input to promote initial oscillation startup. This being much preferable to a deafening (and embarrassing!) silence.

Stephen Woodward’s relationship with EDN’s DI column goes back quite a long way. Over 100 submissions have been accepted since his first contribution back in 1974.

Related Content

- Power amplifiers that oscillate—deliberately. Part 1: A simple start.

- Power amplifiers that oscillate—deliberately. Part 2: A crafty conclusion.

- A pitch-linear VCO, part 1: Getting it going

- A pitch-linear VCO, part 2: taking it further

- Seven-octave linear-in-pitch VCO

The post 5 octave linear(ish)-in-pitch power VCO appeared first on EDN.

Swansea’s CISM to lead new UK Centre for Doctoral Training in semiconductor skills

Global Semiconductor Revenue Grew 21% in 2025, reports Gartner

Worldwide semiconductor revenue totalled $793 billion in 2025, an increase of 21% year-over-year (YoY), according to preliminary results by Gartner, Inc., a business and technology insights company.

“AI semiconductors — including processors, high-bandwidth memory (HBM), and networking components continued to drive unprecedented growth in the semiconductor market, accounting for nearly one-third of total sales in 2025,” said Rajeev Rajput, Sr. Principal Analyst at Gartner. “This domination is set to rise as AI infrastructure spending is forecast to surpass $1.3 trillion in 2026.”

NVIDIA Strengthened its Lead While Intel Continued to Lose Share

Among the top 10 semiconductor vendors ranking, the positions of five vendors have changed from 2024 (see Table 1).

- NVIDIA extended its lead over Samsung by $53 billion in 2025. NVIDIA became the first vendor to cross $100 billion in semiconductor sales, contributing to over 35% of industry growth in 2025.

- Samsung Electronics retained the No. 2 spot. Samsung’s $73 billion semiconductor revenue was driven by memory (up 13%), while non-memory revenue dropped 8% YoY.

- SK Hynix moved into the No. 3 position and totalled $61 billion in revenue in 2025. This is an increase of 37% YoY, fueled by strong demand for HBM in AI servers.

- Intel lost market share, ending the year at 6% market share, half of what it was in 2021.

Table 1. Top 10 Semiconductor Vendors by Revenue, Worldwide, 2025 (Millions of U.S. Dollars)

| 2025 Rank | 2024 Rank | Vendor | 2025 Revenue | 2025 Market Share (%) | 2024 Revenue | 2025-2024 Growth (%) | |||||||

| 1 | 1 | NVIDIA | 125,703 | 15.8 | 76,692 | 63.9 | |||||||

| 2 | 2 | Samsung Electronics | 72,544 | 9.1 | 65,697 | 10.4 | |||||||

| 3 | 4 | SK Hynix | 60,640 | 7.6 | 44,186 | 37.2 | |||||||

| 4 | 3 | Intel | 47,883 | 6.0 | 49,804 | -3.9 | |||||||

| 5 | 7 | Micron Technology | 41,487 | 5.2 | 27,619 | 50.2 | |||||||

| 6 | 5 | Qualcomm | 37,046 | 4.7 | 32,976 | 12.3 | |||||||

| 7 | 6 | Broadcom | 34,279 | 4.3 | 27,801 | 23.3 | |||||||

| 8 | 8 | AMD | 32,484 | 4.1 | 24,127 | 34.6 | |||||||

| 9 | 9 | Apple | 24,596 | 3.1 | 20,510 | 19.9 | |||||||

| 10 | 10 | MediaTek | 18,472 | 2.3 | 15,934 | 15.9 | |||||||

| Others (outside top 10) | 298,315 | 37.6 | 270,536 | 10.3 | |||||||||

| Total Market | 793,449 | 100.0 | 655,882 | 21.0 |

Source: Gartner (January 2026)

The buildout of AI infrastructure is generating high demand for AI processors, HBM and networking chips. In 2025, HBM represented 23% of the DRAM market, surpassing $30 billion in sales while AI processors exceeded $200 billion in sales. AI semiconductors are set to represent over 50% of total semiconductor sales by 2029.

The post Global Semiconductor Revenue Grew 21% in 2025, reports Gartner appeared first on ELE Times.

India aims to be among the major semiconductor hubs by 2032, says Union Minister Ashwini Vaishnaw

India has joined the global race to manufacture semiconductor chips domestically to grow into a major global supplier. Amidst this progress, Union Minister for Electronics and Information Technology Ashwini Vaishnaw outlined how the government is positioning India as a key global technology player.

The Minister informed that the semiconductor sector is expanding rapidly, driven by demand from artificial intelligence, electric vehicles, and consumer electronics. India has made an early start with approvals for 10 semiconductor-related units. Four plants – CG Semi, Kaynes Technology, Micron Technology, and Tata Electronics’ Assam facility – are expected to commence commercial production in 2026.

He also highlighted the visible progress on the design and talent fronts. Currently, design initiatives involve 23 startups, while skill development programmes have been scaled across 313 universities. The domestic landscape is being strengthened by equipment manufacturers who are simultaneously setting up plants in India.

According to Vaishnaw, by 2028, these efforts are bound to make India a reckoning force in the global chip-making market. He said the period after 2028 would mark a decisive phase as industry growth reaches a tipping point. With manufacturing, design, and talent ecosystems in place, India aims to be among the major semiconductor hubs by 2032, including the capability to produce 3-nanometre chips, he added.

While addressing criticism that India’s AI growth is driven largely by global technology firms, Vaishnaw reiterated that sovereign AI remains a national goal. Indian engineers are working across all five layers of the AI stack – applications, models, chipsets, infrastructure, and energy. Twelve teams under the IndiaAI Mission are developing foundational models, several design teams are working on chipsets, and around $70 billion is being invested in infrastructure, supported by clean energy initiatives.

Subsequently, while responding to concerns on the utilisation of domestic OSAT and fabrication capacity, the minister said new industries inevitably face market-acceptance challenges. Success, he stated, will depend on the ability of Indian plants to deliver high-quality products at competitive prices.

The post India aims to be among the major semiconductor hubs by 2032, says Union Minister Ashwini Vaishnaw appeared first on ELE Times.