Новини світу мікро- та наноелектроніки

Weekly discussion, complaint, and rant thread

Open to anything, including discussions, complaints, and rants.

Sub rules do not apply, so don't bother reporting incivility, off-topic, or spam.

Reddit-wide rules do apply.

To see the newest posts, sort the comments by "new" (instead of "best" or "top").

[link] [comments]

I love electronics but this hobby is a racket!

Most retail sellers will sell you a component for 5 to 10 times the price they bought it just because they can, websites like Digikey, Mouser...etc will charge you an obnoxious shipping fee.

Buying from Ebay, Aliexpress and other websites is almost guarantee to end up with a fake component

Any basic diy project will end up costing you at least 5 times as much as an already made product with the same components

[link] [comments]

New Photon 2 Lander!

| submitted by /u/mohitsbhoite [link] [comments] |

Latest issue of Semiconductor Today now available

Malaysia’s Globetronics to manufacture POET’s optical engines

2024: The year when MCUs became AI-enabled

Artificial intelligence (AI) and machine learning (ML) technologies, once synonymous with large-scale data centers and powerful GPUs, are steadily moving toward the network edge via resource-limited devices like microcontrollers (MCUs). Energy-efficient MCU workloads are being melded with AI power to leverage audio processing, computer vision, sound analysis, and other algorithms in a variety of embedded applications.

Take the case of STMicroelectronics and its STM32N6 microcontroller, which features neural processing unit (NPU) for embedded inference. It’s ST’s most powerful MCU and carries out tasks like segmentation, classification, and recognition. Alongside this MCU, ST offers software and tools to lower the barrier to entry for developers to take advantage of AI-accelerated performance for real-time operating systems (RTOSes).

Figure 1 The Neural-ART accelerator in STM32N6 claims to deliver 600 times more ML performance than a high-end STM32 MCU today. Source: STMicroelectronics

Infineon, another leading MCU supplier, has also incorporated a hardware accelerator in its PSOC family of MCUs. Its NNlite neural network accelerator aims to facilitate new consumer, industrial, and Internet of Things (IoT) applications with ML-based wake-up, vision-based position detection, and face/object recognition.

Next, Texas Instruments, which calls its AI-enabled MCUs real-time microcontrollers, has integrated an NPU inside its C2000 devices to enable fault detection with high accuracy and low latency. This will allow embedded applications to make accurate, intelligent decisions in real-time to perform functions like arc fault detection in solar and energy storage systems and motor-bearing fault detection for predictive maintenance.

Figure 2 C2000 MCUs integrate edge AI hardware accelerators to facilitate smarter real-time control. Source: Texas Instruments

The models that run on these AI-enabled MCUs learn and adapt to different environments through training. That, in turn, helps systems achieve greater than 99% fault detection accuracy to enable more informed decision-making at the edge. The availability of pre-trained models further lowers the barrier to entry for running AI applications on low-cost MCUs.

Moreover, the use of a hardware accelerator inside an MCU offloads the burden of inferencing from the main processor, leaving more clock cycles to service embedded applications. This marks the beginning of a long journey for AI hardware-accelerated MCUs, and for a start, it will thrust MCUs into applications that previously required MPUs. The MPUs in the embedded design realm are also not fully capable of controlling design tasks in real-time.

Figure 3 The AI-enabled MCUs replacing MPUs in several embedded system designs could be a major disruption in the semiconductor industry. Source: STMicroelectronics

AI is clearly the next big thing in the evolution of MCUs, but AI-optimized MCUs have a long way to go. For instance, software tools and their ease of use will go hand in hand with these AI-enabled MCUs; they will help developers evaluate the embeddability of AI models for MCUs. Developers should also be able to test AI models running on an MCU in just a few clicks.

The AI party in the MCU space started in 2024, and 2025 is very likely to witness more advances for MCUs running lightweight AI models.

Related Content

- Smarter MCUs Keep AI at the Edge

- Profile of an MCU promising AI at the tiny edge

- 32-bit Microcontrollers Need a Major AI Upgrade

- AI algorithms on MCU demo progress in automated driving

- An MCU approach for AI/ML inferencing in battery-operated designs

The post 2024: The year when MCUs became AI-enabled appeared first on EDN.

The Growing Demand for Edge AI Hardware in Transforming Real-Time Data Processing

The rise of edge computing and the increasing demand for AI-driven applications have led to a significant shift in the way AI models are deployed and processed. Edge AI hardware, or AI accelerators, plays a critical role in enabling real-time deep learning inference on edge devices, allowing them to process and analyze data locally without relying on cloud computing. As industries adopt AI to solve complex problems in real-time, edge AI hardware has become a crucial component in delivering faster, more efficient, and secure AI-powered solutions.

The Need for Edge AI Hardware

Traditionally, AI workloads have been handled by powerful cloud-based systems, where massive amounts of data are transmitted, processed, and analyzed remotely. However, as the number of connected devices and the volume of data generated continues to grow, the limitations of cloud computing have become evident. Cloud-based systems struggle with issues like latency, bandwidth constraints, data privacy concerns, and the high costs of transmitting large amounts of data.

Edge AI hardware addresses these challenges by bringing the computational power directly to the devices, enabling them to make decisions and process data locally. By processing data at the edge, organizations can reduce reliance on cloud infrastructure, lower latency, improve security, and achieve more efficient energy usage, especially for battery-powered IoT devices.

What Is Edge AI Hardware?

Edge AI hardware refers to specialized devices or components designed to accelerate AI processes, particularly deep learning inference, at the edge of a network. Unlike general-purpose processors such as CPUs, AI accelerators are built to handle the unique demands of AI workloads, including the ability to efficiently process large volumes of data in real-time while minimizing power consumption.

The key function of edge AI hardware is to optimize the execution of machine learning models, enabling devices to perform tasks like image recognition, natural language processing, and autonomous decision-making without relying on the cloud for heavy computations. This is particularly important in applications where latency is a critical factor, such as autonomous vehicles, robotics, and smart cities.

The Evolution of Edge Computing and AI

As IoT devices proliferate, the need for efficient data processing has intensified. The vast amounts of data generated by these devices cannot always be efficiently handled by cloud-based systems, and this is where edge computing comes into play. The concept of edge computing involves processing data closer to where it is generated, thereby reducing the distance it needs to travel and minimizing the risk of data loss or delay.

Edge AI builds on this concept by incorporating machine learning capabilities directly into the devices. With the help of edge AI hardware, devices can process data in real-time, learn from it, and make autonomous decisions without the need for constant communication with the cloud. This capability is crucial for sectors that demand rapid decision-making, including healthcare, automotive, and industrial automation.

Benefits of Edge AI Hardware

- Reduced Latency: One of the primary benefits of edge AI hardware is the reduction in latency. When data is processed locally, there is no need to wait for it to be sent to the cloud for analysis, resulting in faster decision-making. This is particularly crucial in time-sensitive applications, such as autonomous driving, where milliseconds can make the difference between an accident and a successful maneuver.

- Improved Bandwidth Efficiency: With edge AI hardware, devices can process data locally, reducing the need for continuous communication with the cloud. This significantly lowers bandwidth usage, helping organizations save on data transmission costs. By minimizing the amount of data sent to the cloud, edge AI also helps prevent network congestion and ensures smoother operations in environments with limited bandwidth.

- Enhanced Privacy and Security: Data privacy and security are major concerns for organizations using cloud-based AI systems, especially when dealing with sensitive or personal information. Edge AI hardware reduces these risks by keeping data on the device, minimizing the chances of data breaches or interception during transmission. For applications in healthcare, finance, or surveillance, the ability to process data locally enhances trust and compliance with data protection regulations.

- Energy Efficiency: Edge AI hardware is designed to be energy-efficient, making it ideal for battery-powered devices that require long operational lifespans. AI accelerators use significantly less power than general-purpose CPUs and GPUs, ensuring that devices can run complex AI models without draining their power source. This is particularly important for applications in IoT, wearable devices, and remote sensors, where energy efficiency is paramount.

Types of Edge AI Hardware

Edge AI hardware comes in various forms, each optimized for different use cases and performance requirements. The most common types of edge AI hardware include:

- AI Accelerators: AI accelerators are specialized processors designed to speed up the inference of machine learning models. These include:

- Tensor Processing Units (TPUs): Developed by Google, TPUs are optimized for deep learning tasks and offer high computational power with low energy consumption.

- Graphics Processing Units (GPUs): GPUs, which are traditionally used for rendering graphics, are well-suited for parallel processing tasks required by AI models, especially deep learning.

- Vision Processing Units (VPUs): VPUs are designed specifically for computer vision tasks and are used in applications like smart cameras and drones.

- Field-Programmable Gate Arrays (FPGAs): FPGAs offer flexibility in terms of reconfiguration and are used for specialized AI tasks in environments where adaptability is essential.

- Application-Specific Integrated Circuits (ASICs): ASICs are custom-designed chips optimized for specific AI tasks. While they are expensive and take time to design, they are highly efficient and provide unmatched performance for specific applications.

- Edge Computing Platforms: These platforms integrate AI accelerators with computing hardware to create a complete solution for edge AI. They often include CPUs, GPUs, memory, storage, and networking capabilities, and are used in applications such as industrial automation, smart cities, and autonomous vehicles.

- Edge AI Modules: Edge AI modules combine AI accelerators with other system components to create compact, ready-to-deploy solutions. These modules are typically used in devices like smart cameras, robotics, and wearables, where space and power are limited.

Use Cases for Edge AI Hardware

The adoption of edge AI hardware is driving innovation in numerous industries. SSeveral key use cases include:

- Autonomous Vehicles: Autonomous vehicles rely heavily on AI to process sensor data from cameras, LiDAR, and radar in real-time. Edge AI hardware enables these vehicles to make split-second decisions without the need for cloud-based processing, ensuring safety and reliability on the road.

- Robotics: Robots equipped with edge AI hardware can perform complex tasks like navigation, object recognition, and decision-making independently. This is particularly useful in industries like manufacturing, logistics, and healthcare, where robots need to operate efficiently and autonomously in dynamic environments.

- Healthcare: Edge AI hardware is transforming healthcare by enabling real-time monitoring and diagnostics. Wearable devices, such as smartwatches and fitness trackers, use edge AI to analyze biometric data, providing users with insights into their health and fitness. In medical imaging, AI accelerators enable quick image analysis, helping doctors make faster diagnoses.

- Industrial Automation: In smart factories, AI-powered robots and sensors equipped with edge AI hardware improve efficiency and reduce downtime. These devices can detect anomalies, predict maintenance needs, and automate tasks without relying on cloud infrastructure.

The Future of Edge AI Hardware

As the demand for real-time AI processing continues to grow, the development of edge AI hardware is expected to evolve rapidly. Advances in AI accelerator technologies, such as more powerful TPUs, GPUs, and custom ASICs, will enable even more sophisticated AI models to run on resource-constrained edge devices.

Additionally, the expansion of 5G networks will boost edge AI capabilities by offering the fast, reliable connectivity needed for large-scale, real-time AI processing. As edge AI continues to gain momentum, it will unlock new possibilities across industries, creating smarter, more efficient, and secure solutions for a wide range of applications.

In conclusion, edge AI hardware is revolutionizing the way AI is deployed and processed. By bringing AI capabilities to the edge of the network, organizations can reduce latency, lower bandwidth costs, improve privacy and security, and achieve energy-efficient solutions. As the demand for real-time AI grows, the role of edge AI hardware will become even more critical, enabling faster, smarter, and more secure AI applications across industries.

The post The Growing Demand for Edge AI Hardware in Transforming Real-Time Data Processing appeared first on ELE Times.

Transforming Industries with Artificial Intelligence in Embedded Systems

The integration of Artificial Intelligence (AI) with embedded systems is transforming industries by enabling smarter, more responsive, and autonomous devices. Embedded systems, traditionally task-specific and resource-limited, now benefit from AI’s ability to process, learn, and make decisions in real-time. This innovation enhances safety, efficiency, and user experience across domains like automotive, healthcare, agriculture, and smart homes.

What Are Embedded Systems?Embedded systems are specialized computers designed to execute specific functions within larger systems, typically operating under real-time constraints. These systems are designed for efficiency, and they include microcontrollers, sensors, and software. They are found in everyday technologies like home appliances, cars, industrial machines, and medical devices. As AI integrates with these systems, they can handle more sophisticated tasks autonomously.

Embedded systems are small, purpose-built computers that operate within larger systems, characterized by:

- Components: Microcontrollers, sensors, and dedicated software.

- Applications: Found in everyday items like home appliances, vehicles, and medical devices.

- Features: Efficient, reliable, and designed for specific tasks with constrained resources.

Adding AI into these systems enhances their ability to handle complex operations, transforming even basic devices into intelligent systems.

Role of AI in Embedded SystemsAI in embedded systems enhances their decision-making capabilities. By processing real-time data from sensors, AI enables devices to learn from the data and make intelligent decisions autonomously. Examples include autonomous vehicles that use AI to navigate safely, and smart home devices that adjust settings based on user preferences. Although there are challenges (e.g., limited power and processing capacity), AI’s integration leads to more efficient and reliable systems.

AI enriches embedded systems by:

- Real-time Decision-Making: Analyzing sensor data to act autonomously.

- Predictive Capabilities: Preempting problems before they occur.

- Improved Accuracy: Making systems smarter and more efficient in applications like:

- Autonomous vehicles for navigation and safety.

- Smart home gadgets for personalized automation.

- Healthcare devices for diagnostics and monitoring.

- Autonomous Vehicles: Real-time object detection and navigation for self-driving cars.

- Smart Homes: Devices like thermostats and security cameras optimize user experience.

- Healthcare: Wearables and imaging systems offer enhanced diagnostics and monitoring.

- Industrial Automation: Robots improve efficiency, reduce downtime, and enhance precision.

- Agriculture: AI-driven drones and sensors optimize irrigation and yield.

- Retail & Supply Chains: Smart shelves and predictive analytics streamline operations.

- Energy Management: AI optimizes renewable energy use and reduces waste.

- Consumer Electronics: Devices offer personalized recommendations and smarter interfaces.

- Aerospace & Defense: AI powers drones and autonomous systems for critical missions.

- Environmental Monitoring: AI-equipped sensors monitor and safeguard ecosystems.

Although the integration of AI in embedded systems offers significant advantages, it also presents several challenges:

- Processing and Power Limitations: Embedded systems often lack the computational power needed for advanced AI.

- Data Security: Handling sensitive data locally requires robust encryption and security measures.

- Interoperability: Ensuring seamless communication between devices is crucial.

Despite these challenges, the opportunities are vast, especially in areas like autonomous systems, smart environments, and industrial efficiency.

Opportunities:

- The advancement of Edge AI and TinyML helps address resource limitations by enabling efficient processing directly on devices with minimal computational power.

- Rapid advancements in areas such as robotics, IoT, and sustainable energy solutions.

- Enhanced user-centric designs, such as wearable health monitors or autonomous systems.

- Edge AI: Data is processed on the device, reducing latency and improving privacy.

- AIoT (AI + IoT): AIoT (Artificial Intelligence of Things) combines AI and IoT technologies to create intelligent, interconnected devices that collaborate and make data-driven decisions more effectively.

- TinyML: Tiny machine learning allows AI to operate on devices with limited resources.

- AI Hardware Accelerators: Custom chips like NPUs or TPUs optimize AI inference.

- Software Toolchains: Frameworks for training, deploying, and optimizing AI models.

- Model Optimization:

- Pruning and quantization reduce model complexity.

- Knowledge distillation helps convey valuable information from larger models to more compact ones.

Real-world examples include:

- Smartwatches/Fitness Trackers: Embedded AI tracks activities in real-time using sensors.

- Autonomous drones use AI to independently navigate and detect obstacles in their environment.

- Medical Devices: AI helps in early detection and monitoring, improving healthcare outcomes.

- Autonomous Driving: Embedded AI processes sensor data for real-time object detection and decision-making.

Embedded AI brings several benefits:

- Bandwidth Efficiency: Reduces reliance on cloud services, lowering data transmission costs.

- Energy Efficiency: Local processing minimizes energy consumption, especially in battery-operated devices.

- Reduced Latency: Real-time data processing ensures quick decision-making, which is vital in applications like autonomous driving.

- Privacy: Is enhanced as data is processed locally on the device, minimizing the potential for breaches.

Performance can be evaluated using benchmarks like MLperf Tiny, which measures inference latency, frames per second (FPS), accuracy, and power efficiency.

Technical EnablersFor embedded AI to thrive, three key enablers are necessary:

- AI Hardware Accelerators: Dedicated processors designed for fast AI computations.

- Software Toolchains: Enable efficient training and deployment of AI models on embedded systems.

- Deep Neural Network Optimization: Techniques like model compression and parameter quantization help optimize performance.

Embedded AI uses a general-purpose framework to support AI functions on devices, enabling real-time data analysis and decision-making without relying heavily on cloud computing. EAI optimizes for lower data transmission costs, better data security, and efficient real-time processing.

Applications of Embedded AI in NetworkingOne fascinating use case of Embedded AI is AI ECN (Explicit Congestion Notification) in networks. AI dynamically modifies the network’s congestion settings in response to real-time traffic conditions, improving data flow and preventing packet loss. This use case showcases the powerful combination of AI and embedded systems in improving operational performance across sectors.

In conclusion, the integration of Artificial Intelligence into embedded systems is revolutionizing industries by enabling devices to process data, learn, and make decisions in real-time. This synergy enhances the capabilities of embedded systems, transforming them from task-specific tools to intelligent, autonomous solutions that deliver improved safety, efficiency, and user-centric experiences. As advancements in hardware accelerators, software optimization, and techniques like Edge AI and TinyML continue to evolve, the opportunities for embedded AI will only expand, addressing challenges such as resource constraints and security. With its potential to reshape sectors ranging from healthcare and automotive to agriculture and networking, embedded AI stands as a cornerstone of technological progress, paving the way for smarter, more connected, and sustainable future systems.

The post Transforming Industries with Artificial Intelligence in Embedded Systems appeared first on ELE Times.

Wide-creepage switcher improves vehicle safety

A wide-creepage package option for Power Integrations’ InnoSwitch 3-AQ flyback switcher IC enhances safety and reliability in automotive applications. According to the company, the increased primary-to-primary creepage and clearance distance of 5.1 mm between the drain and source pins of the InSOP-28G package eliminates the need for conformal coating, making the IC compliant with the IEC 60664-1 reinforced isolation standard in 800-V vehicles.

The new 1700-V CV/CC InnoSwitch3-AQ devices feature an integrated SiC primary switch delivering up to 80 W of output power. They also include a multimode QR/CCM flyback controller, secondary-side sensing, and a FluxLink safety-rated feedback mechanism. This high level of integration reduces component count by half, simplifying power supply implementation. The wider drain pin enhances durability, making the ICs well-suited for high-shock and vibration environments, such as eAxle drive units.

These latest members of the InnoSwitch3-AQ family start up with as little as 30 V on the drain without external circuitry, critical for functional safety. Devices achieve greater than 90% efficiency and consume less than 15 mW at no-load. Target automotive applications include battery management systems, µDC/DC converters, control circuits, and emergency power supplies in the main traction inverter.

Prices for the 1700 V-rated InnoSwitch3-AQ switching power supply ICs start at $6 each in lots of 10,000 units. Samples are available now, with full production in 1Q 2025.

Find more datasheets on products like this one at Datasheets.com, searchable by category, part #, description, manufacturer, and more.

The post Wide-creepage switcher improves vehicle safety appeared first on EDN.

R&S boosts GMSL testing for automotive systems

Rohde & Schwarz expands testing for automotive systems that employ Analog Devices’ Gigabit Multimedia Serial Link (GMSL) technology. Designed to enhance high-speed video links in applications like In-Vehicle Infotainment (IVI) and Advanced Driver Assistance Systems (ADAS), GMSL offers a simple, scalable SerDes solution. The R&S and ADI partnership aims to assist automotive developers and manufacturers in creating and deploying GMSL-based systems.

Physical Medium Attachment (PMA) testing, compliant with GMSL requirements, is now fully integrated into R&S oscilloscope firmware, along with a suite of signal integrity tools. These include LiveEye for real-time signal monitoring, advanced jitter and noise analysis, and built-in eye masks for forward and reverse channels.

To verify narrowband crosstalk, the offering includes built-in spectrum analysis on the R&S RTP oscilloscope. In addition, cable, connector, and channel characterization can be performed using R&S vector network analyzers.

R&S will demonstrate the application at next month’s CES 2025 trade show. To learn more about ADI’s GMSL technology click here.

Find more datasheets on products like this one at Datasheets.com, searchable by category, part #, description, manufacturer, and more.

The post R&S boosts GMSL testing for automotive systems appeared first on EDN.

Gen3 UCIe IP elevates chiplet link speeds

Alphawave Semi’s Gen3 UCIe Die-to-Die (D2D) IP subsystem enables chiplet interconnect rates up to 64 Gbps. Building on the successful tapeout of its Gen2 36-Gbps UCIe IP on TSMC’s 3-nm process, the Gen3 subsystem supports both high-yield, low-cost organic substrates and advanced packaging technologies.

At 64 Gbps, the Gen3 IP delivers over 20 Tbps/mm in bandwidth density with ultra-low power and latency. The configurable subsystem supports multiple protocols, including AXI-4, AXI-S, CXS, CHI, and CHI-C2C, enabling high-performance connectivity across disaggregated systems in HPC, data center, and AI applications.

The design complies with the latest UCIe specification and features a scalable architecture with advanced testability, including live per-lane health monitoring. UCIe D2D interconnects support a variety of chiplet connectivity scenarios, including low-latency, coherent links between compute chiplets and I/O chiplets, as well as reliable optical I/O connections.

“Our successful tapeout of the Gen2 UCIe IP at 36 Gbps on 3-nm technology builds on our pioneering silicon-proven 3-nm UCIe IP with CoWoS packaging,” said Mohit Gupta, senior VP & GM, Custom Silicon & IP, Alphawave Semi. “This achievement sets the stage for our Gen3 UCIe IP at 64 Gbps, which is on target to deliver high performance, 20-Tbps/mm throughput functionality to our customers who need the maximization of shoreline density for critical AI bandwidth needs in 2025.”

Find more datasheets on products like this one at Datasheets.com, searchable by category, part #, description, manufacturer, and more.

The post Gen3 UCIe IP elevates chiplet link speeds appeared first on EDN.

UWB radar SoC enables 3D beamforming

Hydrogen, an ultra-wideband (UWB) radar SoC from Aria Sensing, delivers 3D MIMO beamforming with programmable pulse bandwidths ranging from 500 MHz to 1.8 GHz. Its advanced waveforms support single-pulse and pulse-compression modes, enabling precise depth perception and spatial resolution. The chip optimizes signal-to-noise ratios for various detection tasks while maintaining low radiated power.

Equipped with two integrated RISC-V microprocessors, Hydrogen accommodates up to four transmitting and four receiving antenna channels with flexible and scalable array configurations to enhance cross-range resolution. Offering 1D, 2D, and 3D sensing, the SoC detects presence, position, vital signs, and gestures, serving automotive, industrial automation, and smart home markets.

“Hydrogen represents a paradigm shift in radar technology, combining cutting-edge UWB advancements with compact SoC design. We are excited to see how this innovation will redefine radar sensing applications,” said Alessio Cacciatori, Aria founder and CEO.

The Hydrogen UWB radar SoC supports multiple center frequencies for global operation without sacrificing resolution. It consumes 90 mA at 1.8 V and is housed in a 9×9-mm QFN64 package.

Find more datasheets on products like this one at Datasheets.com, searchable by category, part #, description, manufacturer, and more.

The post UWB radar SoC enables 3D beamforming appeared first on EDN.

GPU IP powers scalable AI and cloud gaming

Vitality is VeriSilicon’s latest GPU IP architecture targeting cloud gaming, AI PCs, and both discrete and integrated graphics cards. According to the company, Vitality offers advancements in computation performance and scalability. With support for Microsoft DirectX 12 APIs and AI acceleration libraries, the GPU architecture suits performance-intensive applications and complex workloads.

![]()

Vitality integrates a configurable Tensor Core AI accelerator and 32 Mbytes to 64 Mbytes of Level 3 cache. Capable of handling up to 128 cloud gaming channels per core, it meets demands for high concurrency and image quality in cloud-based entertainment while enabling large-scale desktop gaming and Windows applications.

“The Vitality architecture GPU represents the next generation of high-performance and energy-efficient GPUs,” said Weijin Dai, chief strategy officer, executive VP and GM of VeriSilicon’s IP Division. “With over 20 years of GPU development experience across diverse market segments, the Vitality architecture is built to support the most advanced GPU APIs. Its scalability enables widespread deployment in fields such as automotive systems and mobile computing devices.”

A datasheet was not available at the time of this announcement.

Find more datasheets on products like this one at Datasheets.com, searchable by category, part #, description, manufacturer, and more.

The post GPU IP powers scalable AI and cloud gaming appeared first on EDN.

Metamaterial’s mechanical maximization enhances vibration-energy harvesting

The number of ways to harvest energy that would otherwise go unused and wasted is extraordinary. To cite a few of the many examples, there’s the heat given off during almost any physical or electronic process, ambient light which is “just there,” noise, and ever-present vibration. Each of these has different attributes along with pros and cons which are fluid with respect to consistency, reliability, and, of course, useful output power in a given situation.

For example, the harvesting of vibration-sourced energy is attractive (when available) as it is unaffected by weather or terrain conditions. However, most of the many manifestations of such energy are quite small. It requires attention to details and design to extract and squeeze out a useful amount in the energy chain from a raw source to the harvesting transducer.

Most vibrations in daily life are tiny and often not “focused” but spread across a wide area or volume. To overcome this significant issue, numerous conversion devices, typically piezoelectric elements, are often installed in multiple locations that are exposed to relatively large vibrations.

Addressing this issue, a research effort lead by a team at KRISS—the Korea Research Institute of Standards and Science in the Republic of Korea (South Korea) —has developed a metamaterial that traps and amplifies micro-vibrations into small areas. The behavior of the metamaterials enhances and localizes the mechanical-energy density level at a local spot in which a harvester is installed.

The metamaterial has a thin, flat structure roughly the size of an adult’s palm, allowing it to be easily attached to any surface where vibration occurs, Figure 1. The structure can be easily modified to fit the object to which it will be attached. They expect that the increase in the power output will accelerate its commercialization.

Figure 1 The metamaterial developed by the KRISS-led team is flat and easy to position. Source: KRISS

Figure 1 The metamaterial developed by the KRISS-led team is flat and easy to position. Source: KRISS

The metamaterial developed by KRISS traps and accumulates micro-vibrations within it and amplifies it. This allows the generation of large-scale electrical power relative to the small number of piezoelectric elements that are used. By applying vibration harvesting with the developed metamaterial, the research team has succeeded in generating more than four times more electricity per unit area than conventional technologies.

Their metasurface structure can be divided into three finite regions, each with a distinct role: metasurface, phase-matching, and attaching regions. Their design used what is called “trapping” physics with carefully designed defects in structure to simultaneously achieve the focusing and accumulation of wave energy.

They validated their metasurface using experiments, with results showing an amplification factor of the input flexural vibration amplitude by a factor of twenty. They achieved this significant amplification largely due to the intrinsic negligible damping characteristic of their metallic structure, Figure 2.

Figure 2 (right) Schematic of the proposed metasurface attachment and (left) a conceptual illustration of the attachment installed on a vibrating rigid structure for flexural wave energy amplification. Source: KRISS

Their phase-gradient metasurfaces (also called metagratings in the acoustic field) feature intrinsic wave-trapping behavior. (Here, the term “metasurfaces” refers to structures that diffract waves, primarily through spatially-varying phase accumulations within the constituent wave channels.)

Constructs, analysis, and modeling are one thing, but a proposal such as theirs requires and is very conducive to validation. Their experimental setup used a vibration shaker and a laser Doppler vibrometer (LDV) sensor to excite and then measure the flexural vibration inside the specimen, Figure 3. For convenience, the specimen was firmly clamped to the shaker instead of being directly attached onto the shaker using a jig and a bolted joint.

Figure 3 (a) Schematic illustration and (b) photographs to demonstrate the experimental setup in order to validate the flexural-vibration amplifying performance of the fabricated metasurface attachment. Using a specially-configured jig and a bolted joint, the metasurface structure is firmly clamped to a vibration shaker. The surface region covering a unit supercell (denoted as M1) and the interfacial line (M2) between the metasurface strips and phase-matching plate are measured using laser Doppler vibrometer equipment. Source: KRISS

The shaker was set to constantly vibrate at frequencies between 3 kHz and 5 kHz at arbitrary weak amplitudes set by a function generator and an RF power amplifier. The phase-matching plate (somewhat analogous to impedance-matching circuit) was another essential component in the structure. It dramatically improved the amplifying performance by assisting coherent phases of scattering wave fields to constantly develop within the metasurface strips in the steady state.

It would be nice to have a summary of before-and-after performance using their design. Unfortunately, their published paper is too much of a good thing: it has a large number of such graphs and tables under different conditions, but no overall summary other than a semi-quantitative image, Figure 4 (top right).

Figure 4 This conceptual illustration graphically demonstrates the nature of the vibration amplification performance of the metamaterial developed by the KRISS-lead team. Source: KRISS

If you want to see more, check out their paper “Finite elastic metasurface attachment for flexural vibration amplification” published in Elsevier’s Mechanical Systems and Signal Processing. But I’ll warn you that at 32 pages, the full paper (main part, appendix, and references) is the longest I have seen by far in an academic journal!

Have you had any personal experience with vibration-based energy harvesting? Was the requisite modeling difficult and valid? Did it meet or exceed your expectations? What sort of real-work problems or issues did you encounter?

Bill Schweber is an EE who has written three textbooks, hundreds of technical articles, opinion columns, and product features.

Related Content

- Nothing new about energy harvesting

- Clever harvesting scheme takes a deep dive, literally

- Energy harvesting gets really personal

- Lightning as an energy harvesting source?

- What’s that?…A fuel cell that harvests energy from…dirt?

The post Metamaterial’s mechanical maximization enhances vibration-energy harvesting appeared first on EDN.

Silicon Carbide: Overview, Discovery, Properties, Process & Uses

Silicon carbide (SiC) is a highly durable crystalline material formed through the combination of silicon (Si) and carbon (C), renowned for its exceptional hardness and resilience. First utilized in the late 19th century, SiC has become a critical material for abrasive tools like sandpapers, grinding wheels, and cutting tools. In modern industries, it is used in refractory linings, heating elements, wear-resistant components, and as a semiconductor substrate in electronic devices like light-emitting diodes (LEDs).

Discovery of Silicon Carbide

Silicon carbide was discovered in 1891 by Edward G. Acheson while attempting to produce artificial diamonds. Acheson utilized an electric arc to heat a combination of clay and powdered coke, producing green crystals that formed on the carbon electrode. Initially mistaken as a compound of carbon and alumina, the material was named “Carborundum” because natural alumina is known as corundum. Recognizing its diamond-like hardness, Acheson patented the compound, which soon became a widely used industrial abrasive due to its cost-effectiveness and availability.

Around the same period, Henri Moissan in France created a similar material using quartz and carbon but recognized Acheson’s prior discovery in 1903. Naturally occurring silicon carbide, known as moissanite, has been found in the Canyon Diablo meteorite in Arizona.

Modern Manufacture of Silicon Carbide

The current manufacturing method for industrial SiC remains largely similar to the Acheson process:

- Raw Materials: A blend of high-purity silica sand and finely powdered coke is carefully prepared.

- Furnace Operation: The materials are arranged around a carbon conductor in an electric resistance furnace.

- Chemical Reaction: Electric current heats the core to 2,200–2,700°C, facilitating the reaction: SiO2+3C→SiC+2CO\text{SiO}_2 + 3\text{C} \rightarrow \text{SiC} + 2\text{CO}

- Post-Processing: After several days, the furnace produces a central core of SiC crystals surrounded by unreacted material. The output is crushed, ground, and screened for various applications.

For specialized uses, advanced processes like reaction bonding, chemical vapor deposition (CVD), and single-crystal growth are employed to create high-purity SiC suitable for electronic or structural applications.

Properties of Silicon Carbide (SiC)

Silicon carbide (SiC) is a unique material that combines exceptional mechanical, thermal, electrical, and chemical properties, making it indispensable in a variety of high-performance applications.

- Mechanical Properties

- Hardness: SiC possesses a Mohs hardness of approximately 9 to 9.5, making it one of the hardest synthetic substances, surpassed only by diamond and boron carbide.

- Strength: It exhibits high strength and remarkable resistance to deformation, making it suitable for applications requiring wear resistance and durability.

- Thermal Properties

- High Thermal Conductivity: SiC boasts excellent thermal conductivity, ranging from ~120 to 270 W/mK, allowing efficient heat dissipation in high-power systems.

- Low Thermal Expansion: The material has a low coefficient of thermal expansion, reducing thermal stress during temperature fluctuations.

- Thermal Stability: SiC maintains exceptional structural integrity and strength at elevated temperatures, with a melting point of approximately 2730°C. This makes it ideal for high-temperature environments such as heating furnaces and molten metal processing.

- Electrical Properties

- Wide Bandgap: With a bandgap ranging from ~2.3 to 3.3 eV (depending on the polytype), SiC is classified as a wide-bandgap semiconductor This characteristic allows for efficient performance in high-temperature and high-voltage applications.

- High Breakdown Voltage: SiC can withstand high electric fields, making it suitable for high-power applications.

- Low Leakage Current: Its electrical properties ensure minimal energy loss, critical for power electronic devices.

- High-Frequency Performance: SiC’s characteristics support high-frequency switching, benefiting applications such as motor drives, inverters, and RF systems.

- Chemical Properties

- Chemical Inertness: SiC is highly resistant to chemical reactions, maintaining stability in harsh environments.

- Corrosion Resistance: It resists oxidation and corrosion from acids, alkalis, and other aggressive chemicals.

- Wear Resistance: The material’s hardness and chemical inertness provide excellent resistance to abrasion and wear.

Applications of Silicon Carbide (SiC)

- Electronics:

- SiC is utilized in power semiconductors such as MOSFETs and diodes, enabling high-efficiency energy conversion.

- It is integral to applications in electric vehicles (EVs), renewable energy systems, and aerospace, thanks to its ability to handle high temperatures and voltages.

- Serves as a substrate for LEDs and other photonic devices.

- Abrasives:

- Due to its exceptional hardness, SiC is used in grinding wheels, sandpapers, and cutting tools, making it ideal for precision machining and polishing.

- Refractories:

- Its thermal stability makes it suitable for lining furnaces, kilns, and high-temperature bricks, ensuring durability in extreme environments.

- Ceramics:

- Plays a key role in producing advanced ceramics for high-performance industrial applications, offering superior mechanical and thermal properties.

- Wear-Resistant Components:

- SiC is used to manufacture pump parts, rocket engine components, and other wear-resistant items, enhancing longevity and reliability.

- Advanced Materials:

- Reinforces composites and ceramics, providing enhanced strength, stiffness, and resistance to thermal degradation.

- LEDs and Photonics:

- A critical substrate material for light-emitting diodes (LEDs) and other photonics applications, enabling improved energy efficiency.

- Nuclear Applications:

- SiC’s high radiation resistance makes it suitable for use in nuclear reactors, where it contributes to safety and efficiency in extreme conditions.

Silicon Carbide Structure

- Crystal Structure:

- SiC exists in multiple crystalline forms called polytypes.

- Common polytypes include 3C-SiC (Cubic), 4H-SiC (Hexagonal), and 6H-SiC (Hexagonal).

- Atomic Arrangement:

- Silicon and carbon atoms are bonded covalently, forming a strong tetrahedral lattice structure.

- This structure contributes to SiC’s extreme hardness and stability.

Silicon Carbide Processing

- Raw Material Preparation:

- Silicon dioxide (SiO₂) and carbon sources like coke or graphite are combined.

- Carbothermal Reduction:

- SiO₂ reacts with carbon at high temperatures (~2000°C) in an electric furnace to form SiC: SiO₂+3C→SiC+2CO\text{SiO₂} + 3\text{C} \rightarrow \text{SiC} + 2\text{CO}

- Crystallization:

- Polytypes are grown using techniques like chemical vapor deposition (CVD) or physical vapor transport (PVT).

- Processing:

- SiC is cut, shaped, or doped for specific applications (e.g., semiconductors).

Advantages of Silicon Carbide (SiC) in Power Electronics and High-Performance Applications

Silicon carbide (SiC), as a wide-bandgap semiconductor material, offers several advantages over traditional silicon (Si) devices, particularly in applications such as inverters, motor drives, and battery chargers. Its unique properties enable superior performance, particularly at higher voltages, making it an attractive choice for new system designs. Below is a comprehensive summary of SiC’s advantages:

- Higher Efficiency

- Reduced Energy Loss: SiC devices exhibit dramatically lower energy losses during switching. The reverse recovery energy loss is approximately 1% of that of silicon counterparts, significantly improving efficiency.

- Faster Turn-Off: SiC’s near absence of tail current allows for faster switching transitions, reducing power dissipation.

- Low Conduction Losses: As a wide-bandgap material, SiC has a low gate charge, requiring less energy for device operation.

- Enhanced Performance at High Temperatures

- Thermal Stability: SiC maintains stable electrical characteristics at elevated temperatures, unlike silicon, which requires over-specification at room temperature to account for performance degradation at high temperatures.

- High Melting Point: With a melting point of approximately 2700°C, SiC retains structural stability in extreme environments, suitable for molten metal processing and high-temperature heating furnaces.

- Smaller, Lightweight Designs

- Higher Switching Frequencies: SiC’s ability to switch at higher frequencies reduces the size and weight of passive components such as transformers and filters, enabling more compact system designs.

- Lower Cooling Requirements: SiC’s efficiency reduces heat generation, minimizing the need for bulky cooling systems.

- Higher Voltage Ratings

- SiC devices can operate at significantly higher voltages, with commercially available devices rated at 1,200V and 1,700V. SiC has demonstrated the potential to operate beyond 10kV, far surpassing silicon capabilities.

- Durability and Longevity

- Higher Reliability: SiC devices offer approximately 10 times the mean time to failure (MTTF) compared to silicon.

- Radiation Resistance: SiC is about 30 times less sensitive to radiation, making it suitable for space and high-radiation environments.

- Corrosion and Wear Resistance

- Chemical Stability: SiC’s strong resistance to acids, alkalis, and oxidative environments enables long-term stability in harsh conditions.

- High Hardness and Strength: With superior hardness and impact resistance compared to traditional ceramics, SiC is ideal for wear-resistant and impact-resistant applications.

- Improved Thermal and Electrical Conductivity

- SiC’s high thermal conductivity makes it an excellent choice for heat dissipation in high-power applications, such as radiators and power electronic components.

- Its superior electrical conductivity supports efficient power conversion and high-frequency operation.

- Packaging and Design Considerations

- Optimized Packaging: To maximize SiC’s benefits, specialized packaging with symmetrical layouts is necessary to minimize loop inductance and support high-frequency switching.

- Advanced Gate Drivers: SiC devices require specifically designed gate drivers to handle faster switching speeds, higher frequency operations, and augmented turn-off techniques to reduce current spikes and ringing.

- Suitability for High-Temperature and Corrosive Environments

- SiC is widely used in fields such as petrochemical processing and high-temperature furnaces due to its robust high-temperature performance and strong corrosion resistance.

Limitations

- Cost: SiC devices are more expensive than silicon, but system-level benefits, particularly at voltages of 1,200V and above, offset this cost.

- Lower Short-Circuit Tolerance: SiC requires fast-acting protection mechanisms, which increase design complexity.

- Limited Availability: SiC devices are less available at lower voltage ratings (e.g., 600V/650V), and most offerings are discrete components.

The post Silicon Carbide: Overview, Discovery, Properties, Process & Uses appeared first on ELE Times.

Digital Multimeter Definition, Types, Working, Uses & Advantages

A digital multimeter (DMM) is an electronic measuring instrument that combines multiple functions into one device. It can measure voltage, current, resistance, and often additional parameters like capacitance, frequency, temperature, and continuity. The readings are displayed on a digital screen, providing high accuracy and ease of use.

History of Digital Multimeter

- Analog Origins: Multimeters began as analog devices, using moving needle mechanisms to display measurements.

- First Digital Multimeter: In the 1970s, advancements in digital electronics led to the development of the first digital multimeters. Early models were bulky and expensive but offered better accuracy than analog counterparts.

- Modern Developments: Over the decades, DMMs have become compact, affordable, and feature-rich, with advanced functionalities such as wireless connectivity and data logging. Companies like Fluke, Tektronix, and Keysight have pioneered innovation in this field.

Types of Digital Multimeters

- Handheld Multimeters:

- Portable and commonly used for general-purpose applications.

- Bench Multimeters:

- Larger and more precise; used in laboratories and industrial settings.

- Clamp Multimeters:

- Specialized for measuring current without direct contact with the conductor.

- Autoranging Multimeters:

- Automatically select the appropriate measurement range for the parameter being tested.

- Fluke Digital Multimeters:

- Known for ruggedness and reliability, often used in industrial applications.

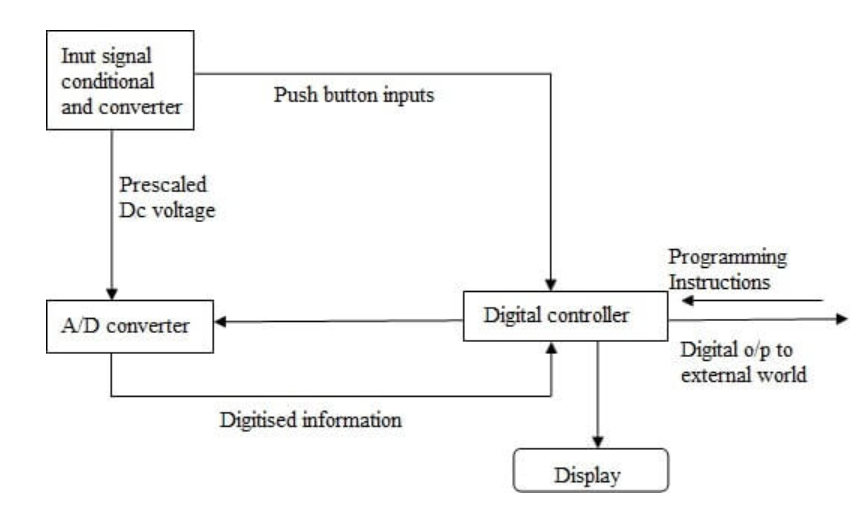

Block Diagram of a Digital Multimeter

The operation of a Digital Multimeter (DMM) is based on precise voltage measurement, which serves as the foundation for calculating other parameters like current and resistance using mathematical relationships. Below is an explanation of the working process alongside a conceptual block diagram.

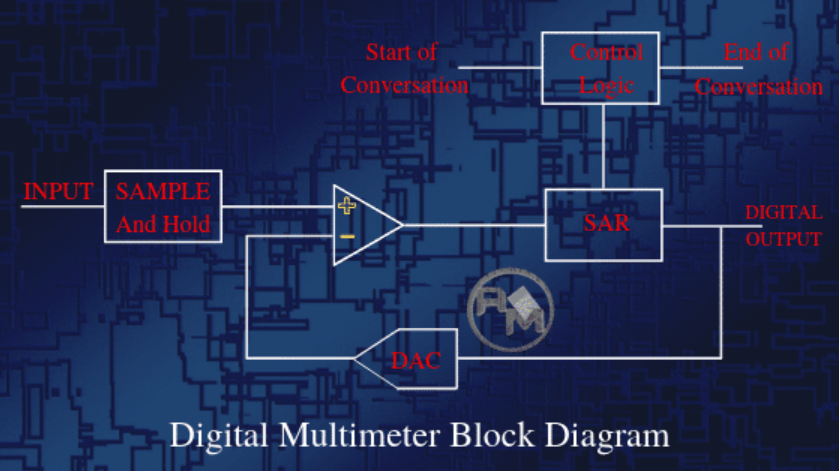

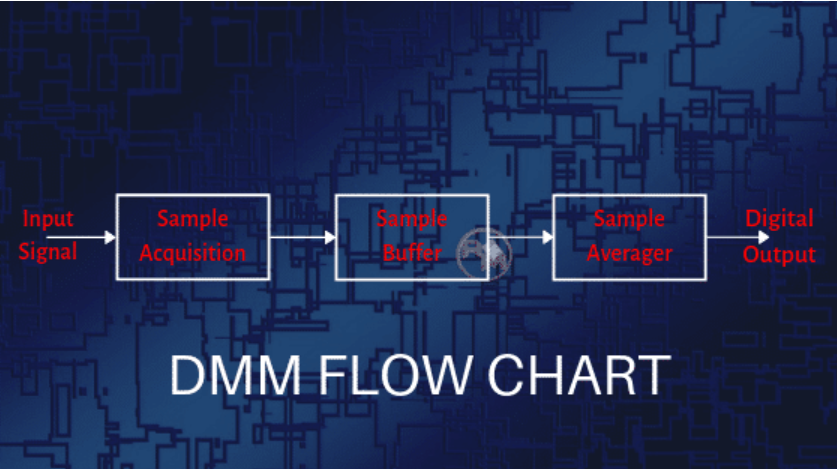

Working Principle

The key process in a digital multimeter involves the measurement and conversion of an analog input voltage into a digital output, which is displayed numerically. The conversion is achieved using a Successive Approximation Register (SAR) Analog-to-Digital Converter (ADC), which is widely employed in DMMs for its speed and accuracy.

- Sample and Hold:

- The first stage of the DMM involves sampling the input voltage.

- The sampled voltage is held steady to ensure accurate processing.

- Operational Amplifier (Op-Amp):

- The sampled input voltage is fed into an operational amplifier.

- The second input of the op-amp receives feedback from a Digital-to-Analog Converter (DAC) that operates in tandem with the SAR ADC.

- Successive Approximation Register (SAR) ADC:

- The SAR ADC determines the digital equivalent of the analog input voltage with high resolution.

- The process begins by setting the Most Significant Bit (MSB) to “1” and others to “0” (e.g., 1000 for a 4-bit system).

- Based on comparisons of the input voltage with the DAC output, subsequent bits are adjusted iteratively.

- Digital Output:

- The SAR ADC provides a stable digital output corresponding to the analog input.

- This result is processed and displayed on the DMM’s digital screen.

Block Diagram

Here’s a high-level description of the components in a DMM:

- Input Section:

- Probes connected to the circuit under test.

- Selector Switch to choose the measurement type (voltage, current, resistance).

- Sample and Hold Circuit:

- Captures and holds the input voltage for processing.

- Operational Amplifier (Op-Amp):

- Amplifies the sampled signal and compares it to feedback from the DAC.

- Digital-to-Analog Converter (DAC):

- Converts the digital output of the SAR ADC back to an analog signal for comparison.

- Successive Approximation Register (SAR) ADC:

- Converts the analog signal into a digital value with high resolution.

- Microcontroller/Processor:

- Processes the digital signal and controls the display output.

- Display Unit:

- Displays the measured value numerically.

Operation Example (4-bit SAR)

For a 4-bit SAR ADC:

- Initially, the output is set to 1000 (MSB = 1).

- If the input voltage is less than half the full-scale range, the comparator output is low, forcing the register to 0100.

- If the voltage exceeds this value, the output progresses to 0110, and so on.

- The process continues until the digital output closely matches the analog input.

This iterative approach ensures precise measurement of the input voltage.

How to Use a Digital Multimeter

- Safety First: Ensure the multimeter is in good condition and the probes are not damaged.

- Set the Mode: Use the rotary dial to select the parameter you want to measure (voltage, current, resistance, etc.).

- Connect the Probes:

- Insert the black probe into the COM port.

- Insert the red probe into the appropriate port based on the measurement.

- Take the Measurement:

- For voltage, connect the probes across the two points.

- For current, break the circuit and connect the probes in series.

- For resistance, connect the probes across the resistor.

- Read the Display: The measurement appears on the screen.

Digital Multimeter Uses

- Testing and troubleshooting electrical circuits.

- Measuring battery voltage and capacity.

- Diagnosing automotive electrical issues.

- Checking continuity in wiring and connections.

- Monitoring industrial equipment and machinery.

- Research and educational experiments.

Advantages of a Digital Multimeter

- High Accuracy: Provides precise measurements with minimal error.

- Ease of Use: Digital readouts are easy to interpret, reducing the chance of misreading.

- Versatility: Combines multiple measurement functions in one device.

- Portability: Compact and lightweight, ideal for fieldwork.

- Safety Features: Built-in protections for high-voltage measurements.

- Advanced Features: Options like autoranging, data logging, and connectivity enhance functionality.

A digital multimeter is an indispensable tool for anyone working in electronics, electrical engineering, or related fields.

The post Digital Multimeter Definition, Types, Working, Uses & Advantages appeared first on ELE Times.

I built it and cannot control it!

| submitted by /u/dothisdothat [link] [comments] |

Merry Christmas

| submitted by /u/Curious_Electronics [link] [comments] |

Save, recall, and script oscilloscope settings

Introduction

Introduction

Digital oscilloscopes have a great thing going for them: they are digital. Instrument settings, waveforms, and screen images can be saved as digital files either internally or to external devices. Not only can they be saved, but they can be recalled to the oscilloscope or an offline program to review the data and, in some cases, for additional analysis and measurements.

The ability to save setups is one of the great benefits of digital oscilloscopes. It saves lots of time setting up measurements, allowing settings of previous work sessions to be recalled and work resumed in seconds. A series of recalled settings can even be the basis for a comprehensive test procedure.

Digital oscilloscopes preserve the last settings when powered down and restore them when power is restored. That can be a problem if that state is not what you need. For instance, If the previous user set the oscilloscope to trigger on an external signal and you want to trigger on one of the internal channels there will be a problem unless you check first and update the settings. The easiest way to ensure the state of the oscilloscope when first powered on is to recall its default setup. The default setup is a known state defined by the manufacturer. The default state is generally helpful in getting data on the screen. It usually places the instrument in an auto-trigger mode so there will be a trace on the screen. Starting with the default state the instrument can be set to make the desired measurement. When that state is reached simply saving that setup state means that it can be recalled at need.

Setup filesSetup file formats vary between oscilloscope suppliers. Teledyne LeCroy uses Visual Basic for setup files. Most other suppliers use Standard Commands for Programmable Instruments (SCPI) for settings. Both use ASCII text which is easy to read and edit.

Figure 1 shows part of a typical setup file for a mid-range Teledyne LeCroy oscilloscope.

Figure 1 Part of a setup file for a Teledyne LeCroy Windows-based oscilloscope using ASCII text-based Visual Basic script. The command for setting the vertical scale of channel 1 is highlighted. Source: Art Pini

The setup files in this oscilloscope are a complete Visual Basic Script. This script can be thought of as a program that when executed sets up the oscilloscope in the state described. When a setting file is saved, it contains a Visual Basic program to restore the instrument settings upon execution. Visual Basic scripts allow the user to incorporate all the power and flexibility of the Visual Basic programming language, including looping and conditional branching.

The control statements for each function of the oscilloscope are based on a hierarchical structure of oscilloscope functions, which is documented in the automation and remote-control manual as well as in a software application called Maui Browser (formerly XStream Browser), which is included with every Windows oscilloscope. The manual includes detailed instructions on using the Maui Browser. The browser connects to the oscilloscope, either locally or remotely, and exposes the automation components as seen in Figure 2.

Figure 2 A view of the Maui Browser, connected locally to an oscilloscope, showing the control selections for channel C1 under the Acquisition function. The vertical scale setting is highlighted. Source: Art Pini

Each functional category of the oscilloscope’s operation is listed in the left-hand column. Acquisition, one of the high-level functions, has been selected in this example. Under that selection is a range of sub-functions related to the acquisition function, including Channel 1 (C1), which has been selected. The table on the right lists all the controls associated with channel 1. Note that the Vertical Scale (Ver Scale) setting has been selected and highlighted. The current setting of 200 mV per division is shown. To the right is a summary of the range of values available for the vertical scale function. The value can be changed on the connected oscilloscope by highlighting the numeric value and changing it to one of the appropriate values within the range.

An example of a simple command is setting the vertical scale of channel 1 (C1) to 200 mV per division. The command structure for the selected command is at the bottom of the figure. All that has to be added is the parameter value, 0.2 in this case- “app.Acquisition.C1.VerScale=0.2”

The Maui Browser is a tool for looking up the desired setting command without the need for a programming manual. It is also helpful for verifying selected commands and associated parameters. The browser program is updated with the oscilloscope firmware and is always up to date, unlike a paper manual.

ScriptingWith Visual Basic scripts being used internally to program the oscilloscope and automate the settings operations, the logical step is to have Visual Basic scripts control and automate scope operations. This operation happens within the oscilloscope itself; there is no need for an external controller. Visual Basic scripting uses Windows’ built-in text editor (Notepad) and the Visual Basic Script interpreter (VBScript), which is also installed in this family of oscilloscopes.

The Teledyne LeCroy website has many useful scripts for their oscilloscopes posted on the website, they perform tasks like setting up a data logging operation, saving selected measurements to spreadsheet files, or using cursors to set measurement gate limits. These can be used as written, but they can also serve as examples on which to base your script. Consider the following example. Figure 3 shows a settings script that allows a zoom trace to be dynamically centered on the position of the absolute horizontal cursor. As the cursor is moved the zoom tracks the movement.

Figure 3 A Visual Basic script that centers a zoom trace on the current horizontal cursor location. Source: Art Pini

The script is copied to the oscilloscope and either recalled using the recall setup function of the oscilloscope or executed by highlighting the script file in Windows File Explorer and double-clicking on it. The script turns on the cursor and the zoom trace and adjusts the center of the zoom trace to match the current cursor’s horizontal location as seen in Figure 4.

Figure 4 The script centers the zoom trace on the absolute horizontal cursor location and tracks it as it is moved. Source: Art Pini

The script operates dynamically; as the cursor is moved, the zoom trace tracks the movement instantly. The script runs continuously and is stopped by turning off the cursor. The message, “Script running; turn off cursor to stop,” appears in the message field in the lower left corner of the screen.

CustomDSOTeledyne LeCroy oscilloscopes incorporate the advanced customization option, including the CustomDSO feature, which allows user-defined graphical interface elements to be called Visual Basic scripts. The basic mode of CustomDSO creates a simple push-button interface used to run setup scripts. The touch of a single button within the oscilloscope user interface can recall scripts. The recalled setups can include other nested setups. This allows users to create a complex series of setups. CustomDSO Plug-In mode will enable users to create an ActiveX Plug-In designed in an environment like Visual Studio and merge this graphical user interface with the scope user interface.

Figure 5 shows the CustomDSO user interface.

Figure 5 The CustomDSO basic mode setup links a user interface push button to a specific setup script file. Source: Art Pini

In basic mode, CustomDSO links eight user interface push buttons with setup scripts. A checkbox enables showing the CustomDSO menu on powerup when no other menu is being displayed.

Figure 6 shows the CustomDSO user interface with the first pushbutton linked to the script to have the zoom center track the cursor.

Figure 6 The user interface for the basic CustomDSO mode with the leftmost pushbutton linked to the zoom tracking script. Source: Art Pini

The basic user interface has eight push buttons that can be linked with setup scripts. In this example, the leftmost push button, which is highlighted, has been linked to the script “Track Zoom.lss”. The oscilloscope uses the root name of the script as the push button label. This capability allows test designers to allow users with less training to recall all the elements of a test procedure.

Some other oscilloscopes can store several setups and then sequence through them as a macro program. This is similar but lacks any flow control when executing the macro.

The Plugin mode of CustomDSO is an even more powerful feature that allows user-programmed ActiveX controls to create a custom graphical user interface. The plugins are powered by routines written in Visual Basic, Visual C++, or other ActiveX-compatible programming languages. Many interactive devices are available, including buttons, a check box, a radio button, a list box, a picture box, and a common dialogue box. A detailed description of plugin generation is beyond the scope of this article.

Recall instrument setupsThe use of Visual Basic scripts enables these oscilloscopes to recall instrument setups easily and enhances this process with the ability to program a series of setups into a test procedure. It also offers the ability to use custom user graphical interfaces to simplify operations.

Arthur Pini is a technical support specialist and electrical engineer with over 50 years of experience in electronics test and measurement.

Related Content

- Customize your oscilloscope to simplify operations

- The scope…from Hell!

- Oscilloscope articles by Arthur Pini

- Basic jitter measurements using an oscilloscope

The post Save, recall, and script oscilloscope settings appeared first on EDN.

Happy Christmas

| Put this together today, looking snazzy. [link] [comments] |